The latest in pharma services

Pharma services, which provide contract and outsourced services throughout the drug development lifecycle, have become a major area of private equity (PE) healthcare investment over the past decade. This trend has been driven by scientific advancements and increased research & development investment, a shift towards more complex specialty drugs and biologics, and significant integration among major contract organisations.

While previously focused on the healthcare provider sector, many PE firms have entered the pharma services market or are planning to do so. However, the market's technical nature requires careful strategy and consideration of cross-border opportunities. As a result, firms are diversifying their expertise through various means such as engaging advisors, partnering with experienced executives, and leveraging consultants.

In this article, we are going to review and summarise the latest report from Pitchbook on pharma services to help our audience understand the opportunities in pharma.

PE activity in pharma

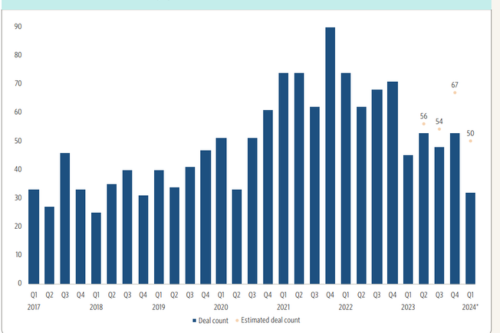

According to Pitchbook, PE deal activity within the pharma services sector saw a 19.2% drop in 2023, in line with reductions across healthcare. The slow trend continued into the first quarter of 2024 with around fifty deals closed or announced. Particularly, 2023 saw 12.9% fewer platform deals compared to the average from 2017-2019.

However, the year did record over 50% more deals than the 2017-2019 period when considering add-ons and minority deals. This is due to sponsors turning to M&A-heavy strategies, like trial site businesses. Q2 2024 also witnessed several platform deal closings of note, such as acquisitions by InTandem Capital Partners, The Riverside Company, and Arsenal Capital Partners.

As the pharmaceutical industry expands into specialised therapeutics, companies increasingly outsource R&D, clinical trials, and manufacturing. Resulting in a blur between CRO and CDMO markets due to combined service offerings. Despite consolidation in the industry, there remain opportunities for smaller CROs specialising in specific therapeutic areas to offer superior services to biotechs and SME pharmaceutical firms.

Additionally, Pitchbook's report details strategies for attracting big pharmaceutical clients, emphasising flexible technology adoption and differentiation through scale, specialization, and client type. It also gives an insight into how CROs and CDMOs are evaluated based on various metrics. Furthermore, it underscores the role of MedTech CROs and CMOs/CDMOs and their heavy reliance on technological innovations. Finally, the document highlights the role of value creation in outsourcing, which focuses on diversification, horizontal M&A, and geographic expansion.

Opportunities in clinical outsourcing

The clinical services market is buoyed by several factors, including a rise in specialty drugs for specific patient groups, increased FDA requirements for trial data that accurately portrays the target demographic, and a growing need for robust clinical research processes. This includes advanced testing, precision medicine, complex trial designs, and ensuring patient safety.

The clinical trial site market is appealing to PE sponsors due to opportunities for multiple arbitrage and operational improvements. Boosted by the COVID-19 pandemic, interest has grown in trial site consolidation and tech enhancement. However, many sites struggle with consistent study pipelines. This market offers potential for diversification, professionalisation, and international expansion. The industry is highly fragmented, with more PE firms interested than available scaled platforms. This has raised transaction multiples. It is now common to build platforms from multiple trial site businesses.

Opportunities in consulting services

Consulting services support pharmaceutical companies in commercial strategy, particularly in the post approval phase. With the industry's increased focus on specialty pharmaceuticals, there is a growing need for outsourced services for more intricate education and engagement strategies. The common investment model for these services includes aggregating specialized capabilities into a single platform for operational scale and cross-selling. However, less well-integrated assets struggled in 2022 and may look to transact after operational improvements in the next 12 to 18 months.

Opportunities in manufacturing and distribution

The manufacturing and distribution segment comprises companies that assist in getting drugs to market post-approval, including full-service outsourced manufacturing companies. Key growth drivers include increasing interest in orphan drugs and personalized medicine, requiring more rapid and specialized manufacturing processes. Additionally, companies selling APIs and intermediates can differentiate themselves via specialisation, product quality, and scale or volume capabilities. Furthermore, the packaging and product distribution & logistics categories are attractive for firms investing in life sciences and industrials firms.

Packaging companies can specialise in advanced products or differentiate via volume, speed, and cost savings. Despite the US pharmacy wholesaler market being dominated by AmerisourceBergen, Cardinal Health, and McKesson, there are opportunities in other countries. The COVID-19 pandemic emphasized the need for rapid scaling in cold chain distribution, with increasing demand for syringe packaging. Another investment area of interest is reverse distributors.

Are you a fund looking for a heavy weight CFO or finance leader for your pharma business?

At Marks Sattin Executive Search, we work with a wide range of investor-led and privately owned businesses across all sectors and locations. With over 30 years of experience, we have helped a number of pharma, healthcare and life science organisations find their next CFO.

If you would like to speak to us about hiring a CFO for your portfolio or your owner-managed business, please don’t hesitate to submit a brief.

Signup to receive the latest discipline specific articles

Related jobs

Salary:

£350 - £450 per day + outside ir35 + hybrid

Location:

City of London, London

Industry

Real Estate

Qualification

None specified

Market

Commerce & Industry

Salary

£350 - £450

Job Discipline

Process Improvement

Contract Type:

Contract

Description

Functional Consultant for this global real estate company's D365 F&O ERP implementation

Reference

BBBH184194

Expiry Date

01/01/01

Author

Joshua Massey

Author

Joshua MasseySalary:

Up to €60,000 per annum

Location:

Rotterdam, South Holland

Industry

Energy, Resources and Industrial

Qualification

None specified

Market

Professional Services

Salary

£50,000 - £60,000

Job Discipline

Part Qualified & Transactional Finance

Contract Type:

Permanent

Description

Als Specialist Financiële Processen SSC binnen een toonaangevende organisatie draag je zorg voor een efficiënte en effectieve afhandeling van financiële administratieve processen.

Reference

BBBH184301

Expiry Date

01/01/01

Author

Aram Outmaijjer

Author

Aram OutmaijjerSalary:

Up to €84,000 per annum

Location:

Rotterdam, South Holland

Industry

Manufacturing

Qualification

Fully qualified

Market

Professional Services

Salary

£70,000 - £80,000

Job Discipline

Qualified Finance

Contract Type:

Permanent

Description

Ben jij een financiële professional met sterke analytische vaardigheden en een strategische visie? Heb je een passie voor procesoptimalisatie en het verbeteren van financiële dienstverlening?

Reference

BBBH184300

Expiry Date

01/01/01

Author

Aram Outmaijjer

Author

Aram OutmaijjerSalary:

£65,000 - £73,000 per annum + Excellent Benefits Package

Location:

Manchester, Greater Manchester

Industry

Consumer & Retail

Qualification

Fully qualified

Market

Commerce & Industry

Salary

£70,000 - £80,000

Job Discipline

Qualified Finance

Contract Type:

Permanent

Description

Exciting Group Reporting Finance Manager for a leading retail organisation based in Manchester offering hybrid working paying circa £70,000.

Reference

BBBH184314

Expiry Date

01/01/01

Author

Nathan Jones

Author

Nathan JonesSalary:

£100,000 - £120,000 per annum + bonus and benefits

Location:

Crawley, West Sussex

Industry

Business Services

Qualification

Fully qualified

Market

Executive Search

Salary

£100,000 - £125,000

Job Discipline

Private Equity Executive Search

Contract Type:

Permanent

Description

Marks Sattin Executive Search is working with a rapidly growing PE-backed buy-and-build B2B business

Reference

TA 3428

Expiry Date

01/01/01

Author

Executive Search

Author

Executive SearchSalary:

£160,000 - £180,000 per annum + Equity, Bonus and Benefits

Location:

North West England

Industry

Education

Qualification

Fully qualified

Market

Executive Search

Salary

£175,000 - £250,000

Job Discipline

Private Equity Executive Search

Contract Type:

Permanent

Description

Marks Sattin Executive Search is currently working with a PE-Backed Education Business seeking an experienced CFO

Reference

TA 3427

Expiry Date

01/01/01

Author

Executive Search

Author

Executive SearchSalary:

Equity, Bonus and Benefits

Location:

London

Industry

Healthcare

Qualification

Fully qualified

Market

Executive Search

Salary

£125,000 - £175,000

Job Discipline

Private Equity Executive Search

Contract Type:

Permanent

Description

Marks Sattin Executive Search is partnering with a dynamic, PE-backed Multisite Healthcare Services business to recruit a CFO.

Reference

TA 3426

Expiry Date

01/01/01

Author

Executive Search

Author

Executive SearchSalary:

Negotiable

Location:

Horsham, West Sussex

Industry

Technology

Qualification

None specified

Market

Commerce & Industry

Salary

£60,000 - £70,000

Job Discipline

Part Qualified & Transactional Finance

Contract Type:

Permanent

Description

Our high growth client in the tech/SAAS industry are looking for a new Transactional Finance Manager to join their finance team.

Reference

129384

Expiry Date

01/01/01

Author

Harry Latham

Author

Harry LathamSalary:

Up to £45,000 per annum

Location:

Leeds, West Yorkshire

Industry

Business Services

Qualification

None specified

Market

Financial Services

Salary

£40,000 - £50,000

Job Discipline

Tax

Contract Type:

Permanent

Description

.

Reference

BBBH184306

Expiry Date

01/01/01

Author

Aleksandra Taranovskaja

Author

Aleksandra TaranovskajaSalary:

£30,000 - £32,000 per annum

Location:

Leeds, West Yorkshire

Industry

Business Services

Qualification

None specified

Market

Commerce & Industry

Salary

£30,000 - £35,000

Job Discipline

Part Qualified & Transactional Finance

Contract Type:

Permanent

Description

Credit Controller in Leeds

Reference

BBBH184266

Expiry Date

01/01/01

Author

Cameron Walsh

Author

Cameron Walsh