European PE breakdown 2025

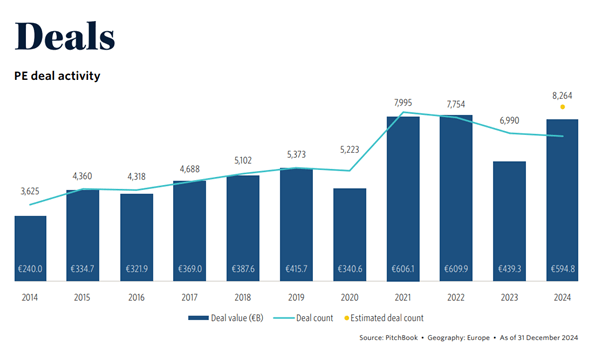

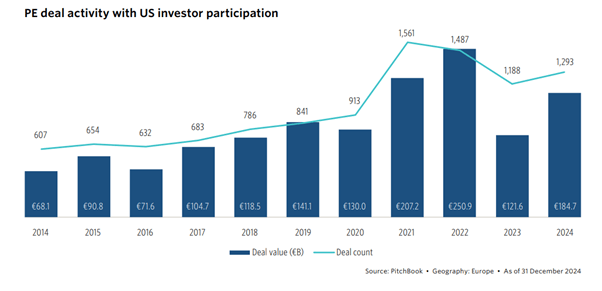

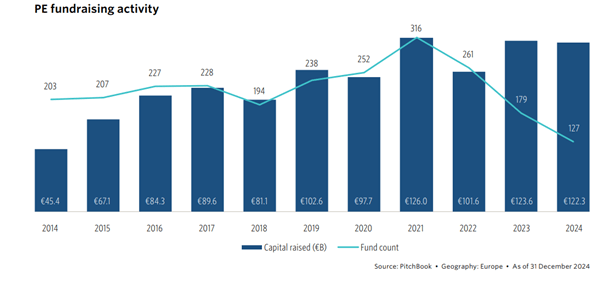

Moreover, a shift in monetary policy improved the economy. Looking forward, we're hopeful that deal making will continue to grow as the economy improves and political instability eases. We also anticipate further growth in the private markets.

What lies ahead in 2025

Are you a fund looking for a heavy weight CFO or finance leader for your investor-led business?

Signup to receive the latest discipline specific articles

Related jobs

Salary:

£130,000 - £150,000 per annum + Equity, Bonus and Benefits

Location:

England

Industry

Private Equity

Qualification

Fully qualified

Market

Executive Search

Salary

£125,000 - £175,000

Job Discipline

Private Equity Executive Search

Contract Type:

Permanent

Description

Marks Sattin Executive Search is partnering with a dynamic, PE-backed consumer facing business to identify a high-calibre Finance Director.

Reference

TA 3410

Expiry Date

01/01/01

Author

Executive Search

Author

Executive Search