UK Private Capital VC Breakdown 2024

According to the latest research from Pitchbook UK's venture capital (VC) is sustaining strong momentum, outperforming last year's figures. Fuelled by AI and fintech sectors, the Q2 recovery was outstanding, the UK's stature as Europe's largest AI hub attracting increased U.S. investment. In H1 2024, AI accounted for £1.8 billion investment across 282 deals, 80 of them involving US investors. However, VC exit activity saw a downturn, more pronounced than in all of Europe

Despite this, sectors like Software as a Service (SaaS), technology, media & telecommunications (TMT), AI, and mobile remained attractive to buyers. Though UK's listing activity lagged, with 74.4% H1 exits being acquisitions and 24.4% buyouts, potential improvements are expected with the Financial Conduct Authority's (FCA) new listings reforms. Fundraising, while slower than last year, is adopting a specialised trend, with 75% of H1 fund closures by emerging managers. A notable shift towards climate-related funding solutions enhances portfolio diversification, allowing for strategic hedging in VC allocations.

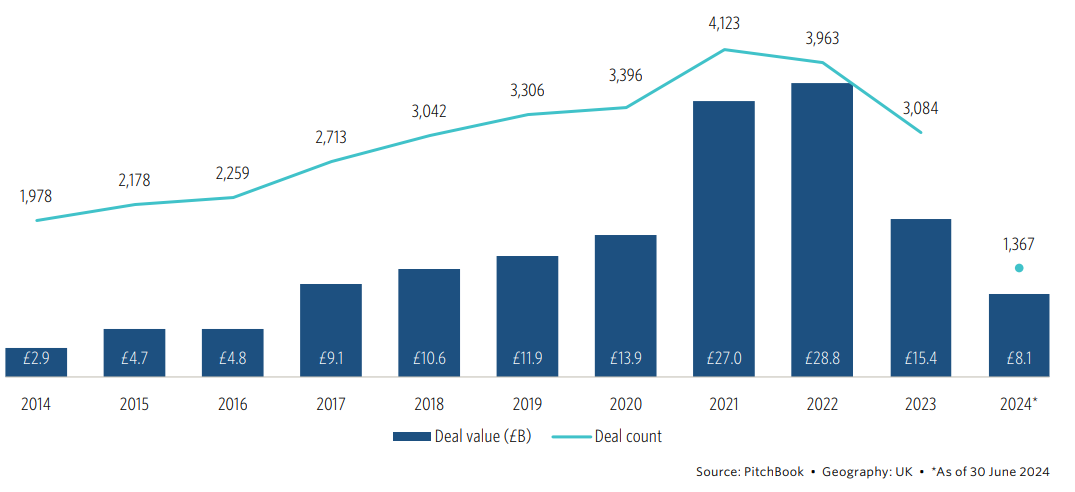

VC deals activity

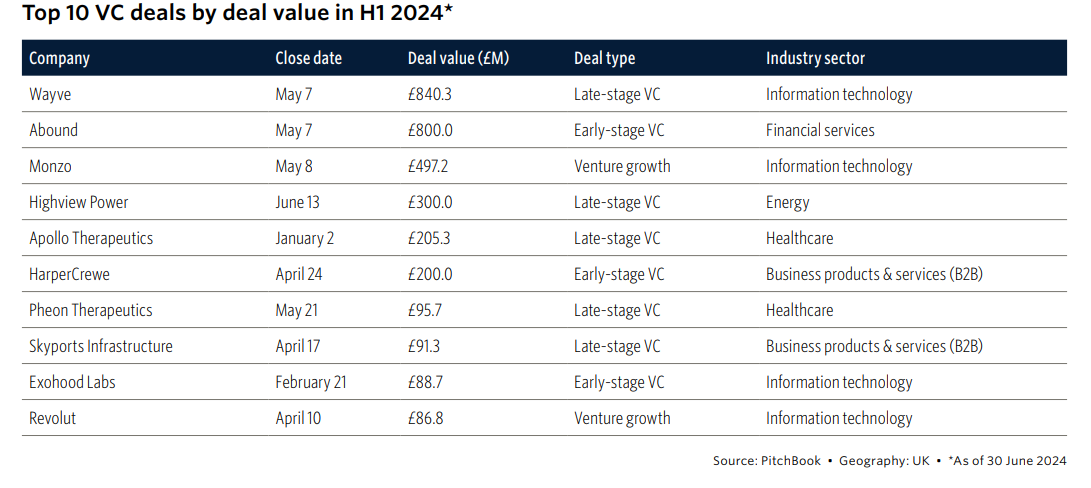

The first half of 2024 saw a recovery in venture capital deal activity in the UK, indicating a 5% YoY increase. The second quarter demonstrated significant growth as we previously discussed, achieving £5.7 billion, thanks to large transactions in the AI and fintech sectors. Standout deals include Wayve's £840.3 million venture led by NVIDIA and SoftBank, and Abound's £800 million mix of debt and equity deal.

Monzo secured nearly £500 million, and rival Revolut received a notable $110 million following its attainment of a banking license in Mexico. The deals varied across sectors, however, the largest part of the UK deal value was still captured by late-stage firms, which constituted 48.1% during this period. Half of the top 10 deals came from late-stage companies. The median deal size increased to £2.8 million in H1 from £2.4 million in 2023, with the median post-money valuation rising to £12 million from £11.8 million last year.

UK deal activity highlights SaaS as the leading vertical, with its H1 run rate suggesting a 58.4% YoY rise, surpassing fintech and AI & ML. Despite the UK's fintech strength, and rising valuations for Revolut and Monzo, AI & ML is a growing sector, with £1.8 billion investment in H1 2024. The UK remains Europe's top AI hub, even as France advances. Meanwhile, mobile commerce trails behind, even though foodtech and bigger public players like Just Eat Takeaway, Deliveroo, Boohoo, and ASOS, are maturing within the UK.

US involvement in the UK is growing, driven by exciting new industries. Emerging as a key player in Europe's AI boom, the UK is attracting increased American investment. The first half of this year saw 340 deals involving US investors, totalling £5.6 billion. This suggests a promising 17.5% annual increase in deal value, with growth outpacing overall market recovery.

The venture market has witnessed a 5.3% YoY increase in deal value this year, owing to an increase in AI-related deals, particularly by key American investors like Andreessen Horowitz, Sequoia Capital, and Lightspeed Venture Partners. With offices now in London, the European ecosystem is drawing both local and international investors. Recently, UK's Balderton Capital led the charge by raising $1.3 billion for European startups.

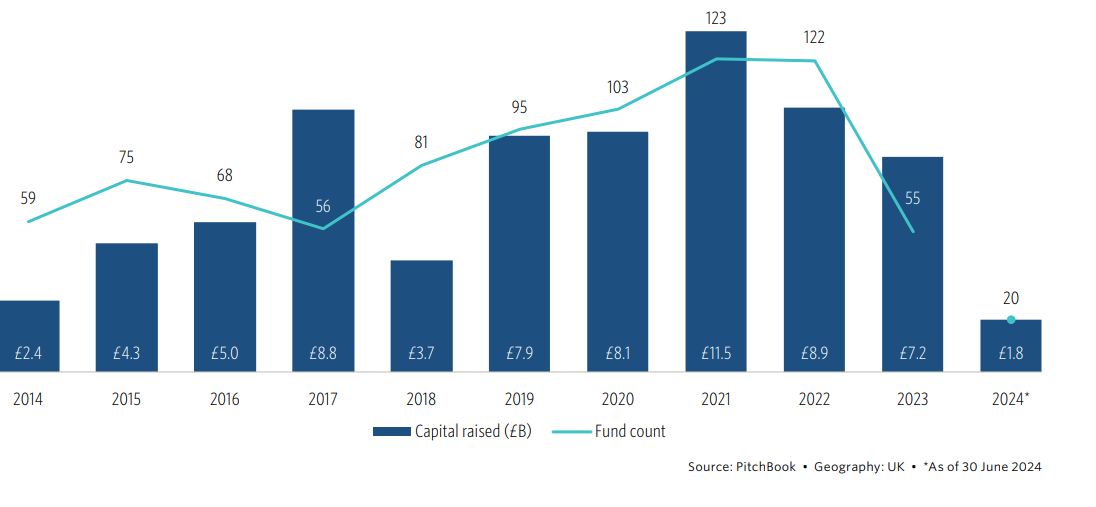

VC fundraising activity

According to a venture capital journal study, UK venture capital fundraising for H1 2024 stood at £1.8 billion, pacing at half the rate of 2023. If the trend continues, the annual fundraising could decline by 51.4%, a stark contrast from the resilience of 2023. The majority of fund closes were under £50 million, often managed by first-timers, mirroring wider European trends favouring smaller, emerging firms. Amid stringent circumstances, smaller firms seem to meet targets more easily, contributing to the shifting narrative towards fund strategy specialisation.

Unlike the broad approach traditionally seen in larger firms, these smaller vehicles demonstrate dedicated, unique strategies within the market, often focusing on specific regions. For instance, Accel London’s eighth fund, the top close of H1, is dedicated to early-stage startups in Europe and Israel, having the only vehicle exceeding £500 million. The Environmental Technologies Fund IV and North East Fund—focused on North East England startups—follow, indicating the dispersion of capital beyond London.

Are you a fund looking for a heavy weight CFO or finance leader for your investor-led business?

At Marks Sattin Executive Search, we work with a wide range of investor-led and privately owned businesses across all sectors and locations. With over 30 years of experience, we have helped a number of organisations find their next CFO. If you would like to speak to us about hiring a CFO for your portfolio or your owner-managed business, please don’t hesitate to submit a brief.

Signup to receive the latest discipline specific articles

Related jobs

We are sorry we can't find what you're looking for

Why not try one of the following ...