UK Private Capital PE Breakdown 2024

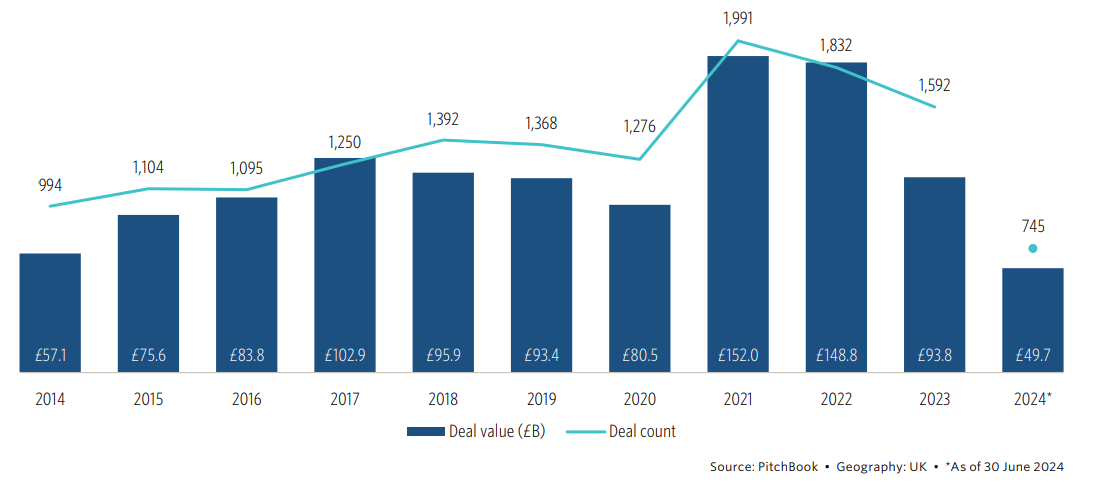

Recent research from Pitchbook reveals that UK private equity is building strong momentum in 2024, with a notable surge in deal value that highlights significant year-over-year growth. As we mentioned in an earlier article, Q2 witnessed the highest deal value in two years, and Leveraged Buyout (LBO) megadeals increased considerably. Interestingly, the UK has been a major player in the take-private deals, accounting for half of Europe's activity in H1.

Fundraising in the PE sector is on pace for a record year with £29.3 billion secured in H1. However, the trend of growth funds losing share to buyout funds continues, and the time taken to close funds is rising. The UK PE market presents a mixed bag of challenges and opportunities.

PE deals activity

UK tech deals rising

KPMG UK's latest M&A study revealed mid-market private equity investment activity in the UK declined by 11% in the first half of 2024.The IT sector in the UK is set for a banner year in private equity deal activity, claiming 29.4% of deal value in H1, the highest since 2016. Notably, software companies including Darktrace, Jagex, IQGeo have attracted major deals. This sector, which experienced valuation volatility with rising interest rates, is poised to gain significantly from falling rates. Often identified as high-margin businesses with predictable revenues and low capital costs, software companies are becoming central to investment strategies of certain firms, proving especially convenient for integration as add-ons to platform companies.

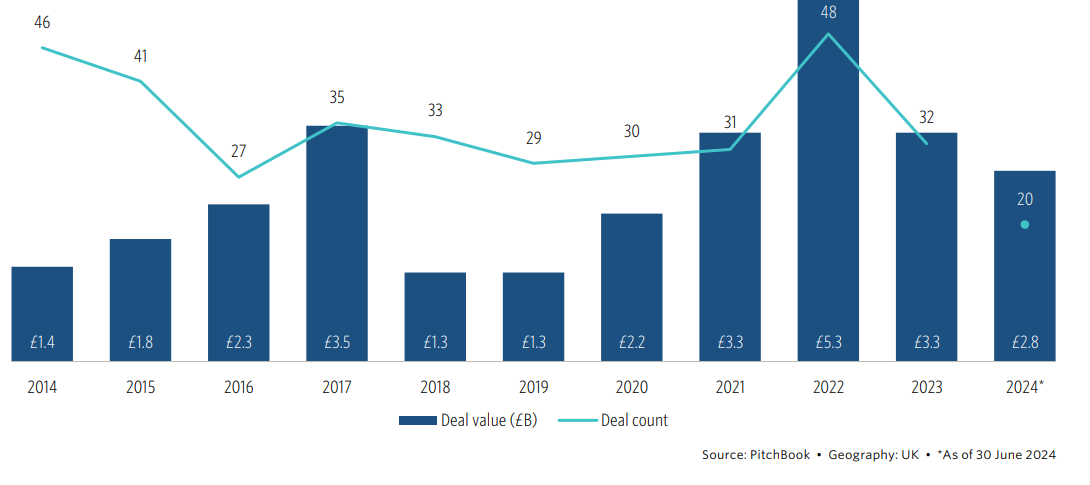

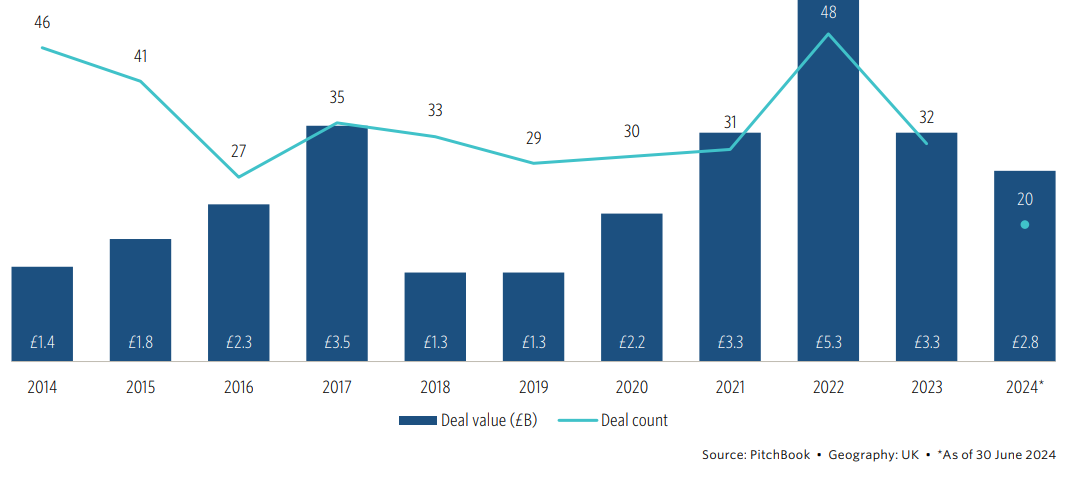

Cleantech and climate tech PE deal activity

Cleantech, a priority for the new government

Financial services still the beating heart of the UK

The financial services sector has seen a surge in activity,

notably strong in Q2 with 49 deals and £5.1bn deal value. Despite Brexit, London

remains Europe's financial heart, hosting major institutions from

investment banks to fintech firms. Rise in interest rates over the past two

years has posed challenges for some companies but also opened up dealmaking

opportunities.

PE Fundraising activity

Are you a fund looking for a heavy weight CFO or finance leader for your investor-led business?

Signup to receive the latest discipline specific articles

Related jobs

We are sorry we can't find what you're looking for

Why not try one of the following ...