European Pitchbook PE breakdown 2024 Q2

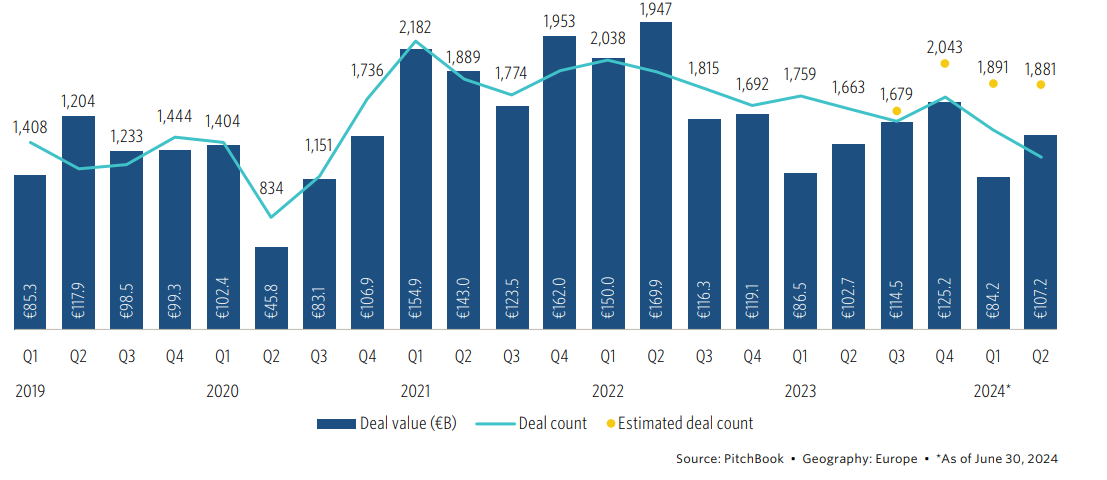

Global markets have been on a positive streak since November 2023, indicating a potential upturn for LPs and private markets. Investors appear more confident as demonstrated through rising average and median deal sizes. There's notable outperformance in the cleantech sector, particularly in renewable energy, with large deals closed for Neoen, Terna Energy, and Atlantica Sustainable Infrastructure, setting the stage for a record-breaking year.

PE deal activity by quarter

Europe is set to benefit from an ECB rate cut

Deal size is rising again

Megafunds drive strong fundraising

According to Pitchbook, 2024 is set to be a record-breaking year for European PE fundraising,. Key megafund closures in Q2 have solidified this trend, with major players like Partners Group Direct Equity V, Bregal Unternehmerkapital, and EQT leading the charge. While each fund has its unique focus – ranging from midsize companies in software and healthcare to business services and industrial technology – all have capitalised on the industry's growth. Notably, EQT, while based in Europe, is eyeing investment opportunities in Asia, exemplifying the global reach of this European surge. This growth trend is emphasised by the enhanced fundraising for middle-market growth funds, which have outperformed expectations by raising double their initial targets.

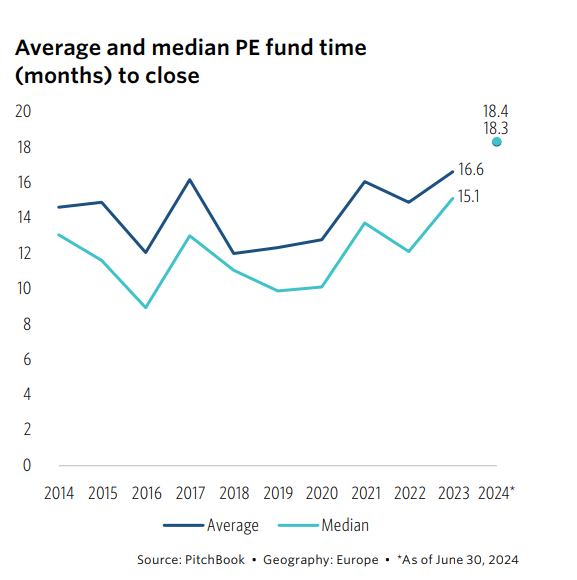

Fundraising timelines increase

Over the past two years, the fundraising landscape has been challenging for most managers, and particularly for first-time and smaller fund managers. Factors such as interest rate increases, falling stock markets, and lack of exits have all contributed to difficulties in capital raising. The average fundraising timeline has expanded significantly from 12.1 months in 2022 to 18.4 months by H1 2024, affecting almost all General Partners. However, as central banks gear towards monetary easing, Pitchbook is predicting a potential easing of these fundraising bottlenecks heading into 2025.

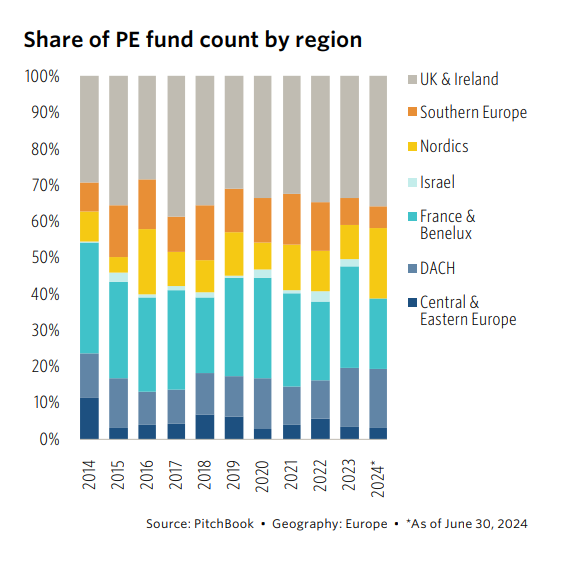

Nordic fundraising remains sturdy

H2 fundraising pipeline

The first quarter of 2024 experienced noticeably large fund closes, setting a high standard for the quarters to follow. However, with a considerable number of open funds predicted to close within the year, 2024 is poised to be a consecutive record-breaking year for capital raised in Europe. By the midpoint of the year, General Partners (GPs) had secured 75% of the prior year's capital. As economic conditions improve, it is expected that fundraising in Europe will continue to thrive in the latter half of 2024.

Are you a fund looking for a heavy weight CFO or finance leader for your investor-led business?

At Marks Sattin Executive Search, we work with a wide range of investor-led and privately owned businesses across all sectors and locations. With over 30 years of experience, we have helped a number of organisations find their next CFO. If you would like to speak to us about hiring a CFO for your portfolio or your owner-managed business, please don’t hesitate to submit a brief.

Signup to receive the latest discipline specific articles

Related jobs

We are sorry we can't find what you're looking for

Why not try one of the following ...