Global Private Debt Report

Global Private Debt Report

To better understand why private debt has performed so well, we have analysed this report from Pitchbook and highlighted some the reports key takeaways.

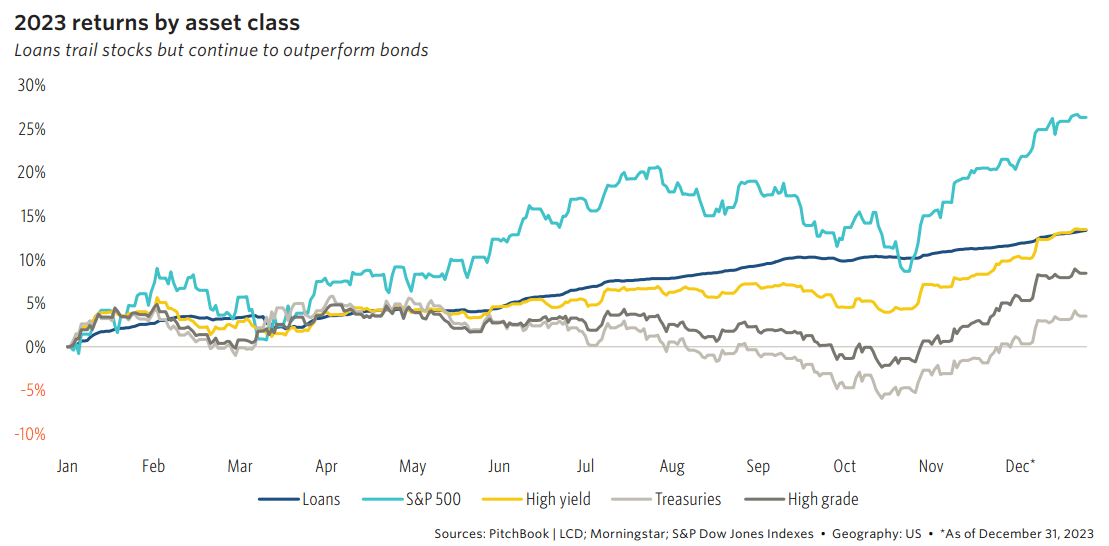

Why has private debt performed so well?

Fundraising and dry powder in private debt

Private debt fundraising in the traditional institutional channel slowed down in the second half of the year. This was due to increased interest in more liquid alternatives offering similar returns. Around $76.7 billion was raised in private debt funds in H2, down from $112.6 billion in H1 2023. However, the total fundraising for 2023 is expected to surpass $200 billion for the fourth consecutive year. Private debt has now become the second-largest private market strategy in terms of annual fundraising, surpassing venture capital.

Private debt strategies

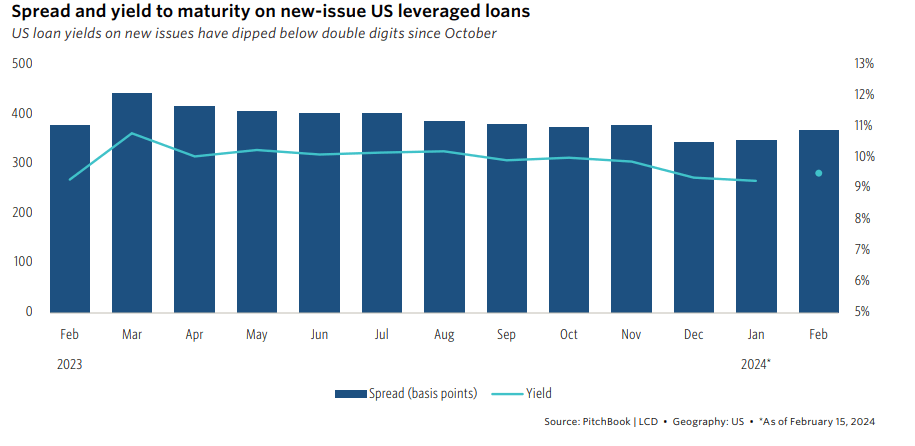

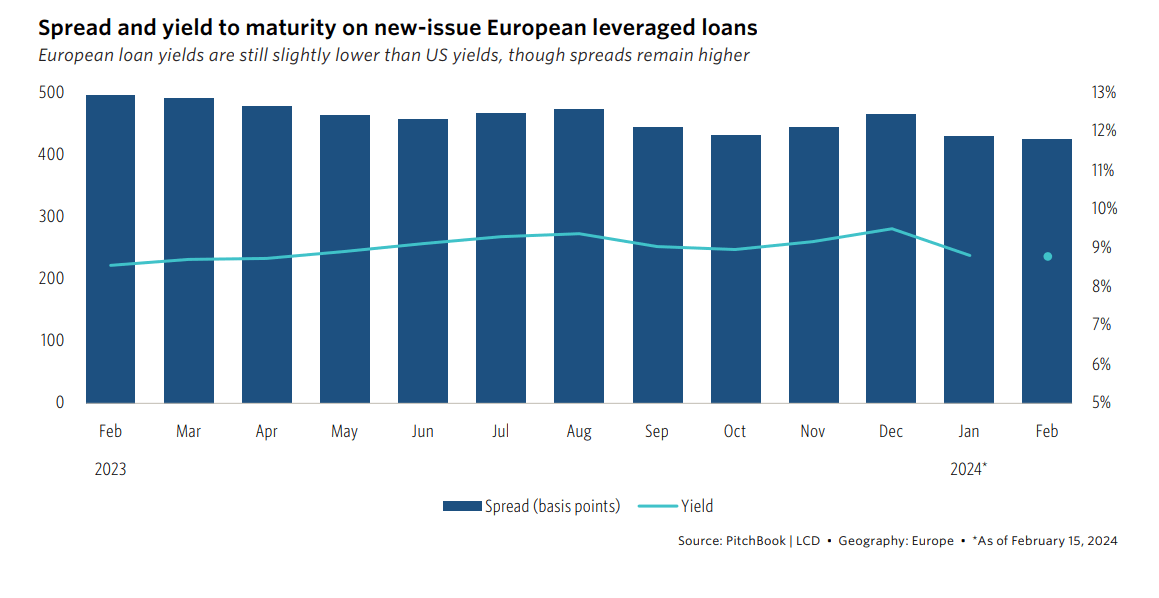

US and European market stats

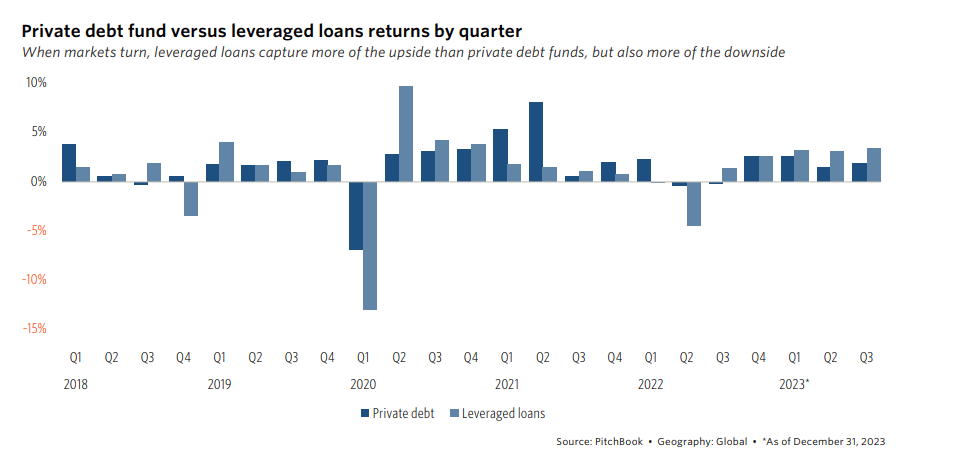

While interest rates are higher today, investor appetite for private debt remains because in addition to the income generation, these funds provide diversification benefits, high risk-adjusted returns, and a hedge against inflation, among other benefits.’’

Jamal Hagler | Vice President of Research American Invest

Private debt fund performance

Find your next investor-led CFO or Executive Finance role with Marks Sattin Executive Search

At Marks Sattin Executive Search, we work with a wide range of investor-led and privately-owned businesses across all sectors and locations. With over 30 years of experience, we have helped more than several professionals find their next exciting opportunity.

Apply for an available CFO or Executive Finance job with us today or register your details and we will contact you at the earliest convenience.

Signup to receive the latest discipline specific articles

Related jobs

Salary:

£80,000 - £85,000 per annum + Additional benefits

Location:

City of London, London

Industry

Consumer & Retail

Qualification

None specified

Market

Commerce & Industry

Salary

£80,000 - £100,000

Job Discipline

Process Improvement

Contract Type:

Permanent

Description

Our global client are looking for an R2R Business Process Owner to lead on their Microsoft Dynamics 365 (F&O) ERP implementation.

Reference

BBBH184245

Expiry Date

01/01/01

Author

Joshua Massey

Author

Joshua MasseySalary:

£300 - £400 per day

Location:

London

Industry

Real Estate

Qualification

Fully qualified

Market

Commerce & Industry

Salary

£350 - £450

Job Discipline

Qualified Finance

Contract Type:

Contract

Description

Interim Group Accountant | 3-month contract | £300-400 Per Day (Inside IR35)

Reference

BBBH183914

Expiry Date

01/01/01

Author

Jaden Alie

Author

Jaden AlieSalary:

£50,000 - £57,000 per annum + bonus (10%)

Location:

Blackburn, Lancashire

Industry

Consumer & Retail

Qualification

Fully qualified

Market

Commerce & Industry

Salary

£50,000 - £60,000

Job Discipline

Finance Change

Contract Type:

Permanent

Description

Our client, a market leading highly acquisitive business are seeking a Finance Transformation Accountant to join their Head Office Finance team.

Reference

BBBH184069

Expiry Date

01/01/01

Author

Laura Halloran

Author

Laura HalloranSalary:

£55,000 - £65,000 per annum + Benefits

Location:

Bury, Greater Manchester

Industry

Consumer & Retail

Qualification

Fully qualified

Market

Commerce & Industry

Salary

£60,000 - £70,000

Job Discipline

Qualified Finance

Contract Type:

Permanent

Description

Our client - a market leader in their industry are currently looking to recruit a new Finance Business Partner to their Head Office finance team.

Reference

BBBH184106

Expiry Date

01/01/01

Author

Laura Halloran

Author

Laura HalloranSalary:

Negotiable

Location:

London

Industry

Consumer & Retail

Qualification

Finalist / Newly qualified

Market

Commerce & Industry

Salary

£70,000 - £80,000

Job Discipline

Newly Qualified Finance

Contract Type:

Permanent

Description

A high-end, luxury fashion brand is currently seeking an Commercial Finance Analyst to join their growing finance team.

Reference

183513

Expiry Date

01/01/01

Author

Harry Latham

Author

Harry LathamSalary:

£55,000 - £60,000 per annum + Free travel

Location:

London

Industry

Consumer & Retail

Qualification

Finalist / Newly qualified

Market

Commerce & Industry

Salary

£60,000 - £70,000

Job Discipline

Newly Qualified Finance

Contract Type:

Permanent

Description

Our client in the transport and logistics sector is looking for a new Management Accountant to join their growing team in London.

Reference

184241

Expiry Date

01/01/01

Author

Harry Latham

Author

Harry LathamSalary:

£65,000 - £75,000 per annum

Location:

City of London, London

Industry

Pharmaceuticals & Life Sciences

Qualification

Fully qualified

Market

Commerce & Industry

Salary

£70,000 - £80,000

Job Discipline

Qualified Finance

Contract Type:

Contract

Description

Finance Business Partner role with a globally renowned research organisation that will assist with upcoming projects within the team.

Reference

BBBH184240

Expiry Date

01/01/01

Author

Julia Aruci

Author

Julia AruciSalary:

£70,000 - £75,000 per annum + Bonus & Pension

Location:

Immingham, Lincolnshire

Industry

Energy, Resources and Industrial

Qualification

None specified

Market

Commerce & Industry

Salary

£70,000 - £80,000

Job Discipline

Information & Cyber Security

Contract Type:

Permanent

Description

A Cyber Risk Management Lead job with an Energy Company based in Lincolnshire.

Reference

BBBH184141

Expiry Date

01/01/01

Author

Alex Dando

Author

Alex DandoSalary:

£200 - £225 per day + Via Umbrella

Location:

London

Industry

Investment Banking & Capital Markets

Qualification

None specified

Market

Financial Services

Salary

£150 - £250

Job Discipline

Risk

Contract Type:

Contract

Description

Risk Administrator - 6 Month Contract £200 - £225 per day Via Umbrella or £30,000 - £35,000 FTC

Reference

BBBH184236

Expiry Date

01/01/01

Author

Deem NaPattaloong

Author

Deem NaPattaloongSalary:

£40,000 - £50,000 per annum

Location:

London

Industry

Consumer & Retail

Qualification

Part qualified

Market

Commerce & Industry

Salary

£50,000 - £60,000

Job Discipline

Part Qualified & Transactional Finance

Contract Type:

Permanent

Description

A vibrant hospitality and events company is looking for a commercially minded Finance Business Partner to join the team.

Reference

KD8181

Expiry Date

01/01/01

Author

Kimberley Donovan

Author

Kimberley Donovan