Healthcare Funds Report

We recently reviewed Pitchbook’s latest Healthcare Funds Report the trends in the market.

In the first half of 2024, a distinct divide has emerged between Private Equity (PE) and Venture Capital (VC) healthcare specialist managers. Since 2012, PE has noticeably leaned towards healthcare specialists, contributing to 3.4% of the closed dollars and 4.3% of 2024 funds. Despite stringent regulations and public scrutiny, the vast, fragmented, and innovative landscape of healthcare continues to pique the interest of Limited Partners (LPs).Despite stringent regulations and public scrutiny, the vast, fragmented, and innovative landscape of healthcare continues to pique the interest of Limited Partners (LPs). Furthermore, the increasing competitiveness in healthcare PE pushes specialists to set themselves apart by developing robust investment theses and providing comprehensive operational support for their portfolio companies.

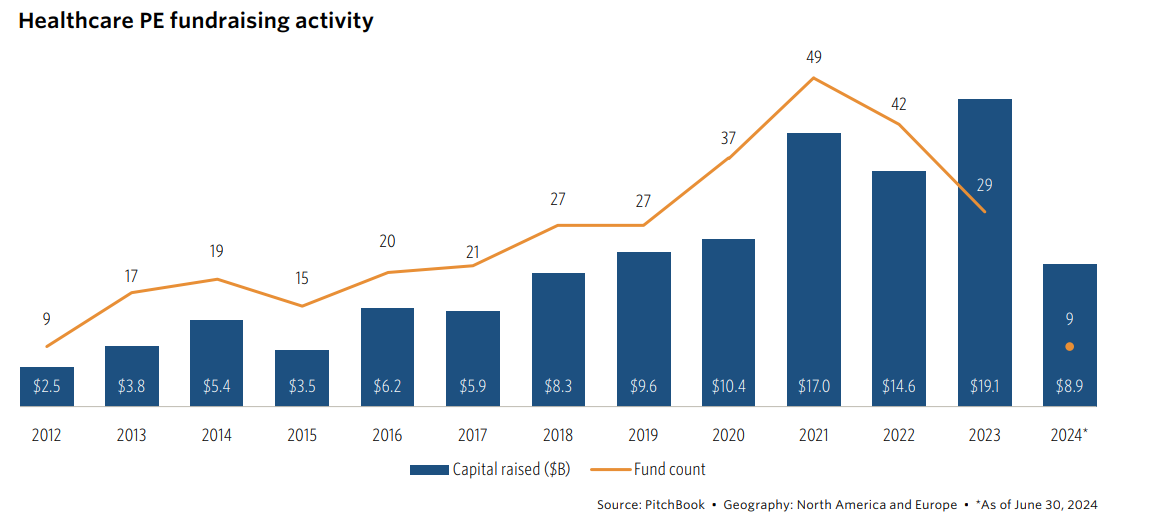

Despite challenges in 2023, PE healthcare specialist managers maintain strong capital raising momentum. By mid-2024, nine funds garnered a collective $8.9 billion with 69.7% of dollars amassed by $1 billion-plus funds, demonstrating increasing capital concentration. Influential middle-market managers are progressing to the upper middle market, potentially marking a shift in the large cap category. However, the fundraising pace is decelerating, leading to fewer fund launches and closures annually. Nevertheless, cumulative dollars remain steady, even as fund closures decrease in number.

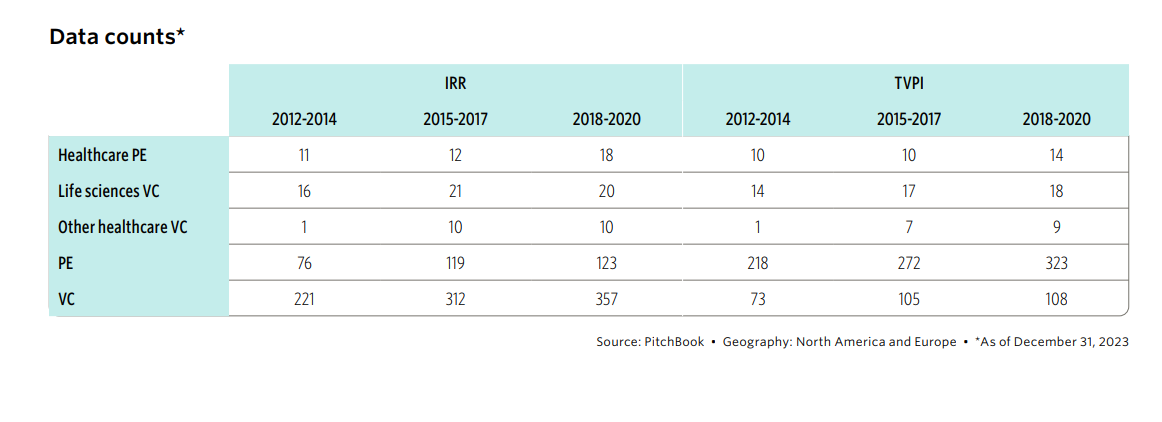

Pitchbook’s latest research uncovers that sector specialisation doesn't necessarily lead to outperformance in PE or VC across sectors. Focusing on healthcare specialists, the findings suggest a varied performance landscape. The data shows VC healthcare specialists, excluding those in life sciences, tend to underperform across all vintage buckets, although caution is advised due to low data counts.

Healthcare PE firms differentiate amid growing competition

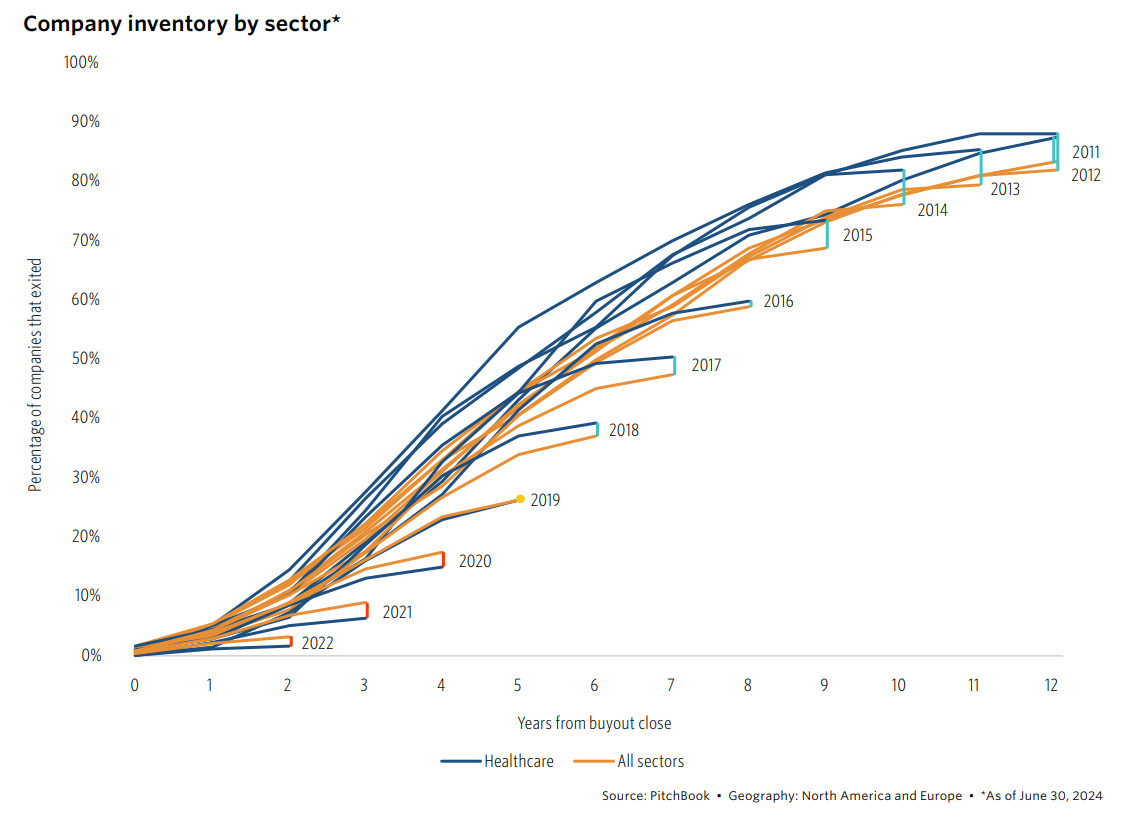

Our analysis compared J-curves across PE fund styles and examined how PE managers have exited healthcare investments over time. While an earlier exit doesn't always equate to higher returns, there's a notable correlation with the time-sensitive IRR metric. Our detailed findings reveal that PE firms have shown a higher exit rate in healthcare investments made from 2012 to 2015, compared to those in other sectors.

This success was driven by targeted investment in high-margin specialties and consolidation of prime healthcare assets. However, from 2016 onwards, the sector began to diversify, entering lower-margin sectors and expanding into healthcare IT and life sciences. The increased competition and higher valuations culminated in the turbulent period of 2020 to 2022, marked by the COVID-19 pandemic and labour shortages, causing a significant slowdown in exits. If current trends persist, it is projected that healthcare funds from 2019 to 2022 will underperform compared to the broader asset class.

Are you a healthcare fund looking for a heavy weight CFO or finance leader?

Signup to receive the latest discipline specific articles

Related jobs

We are sorry we can't find what you're looking for

Why not try one of the following ...