European Q3 PE Breakdown 2024

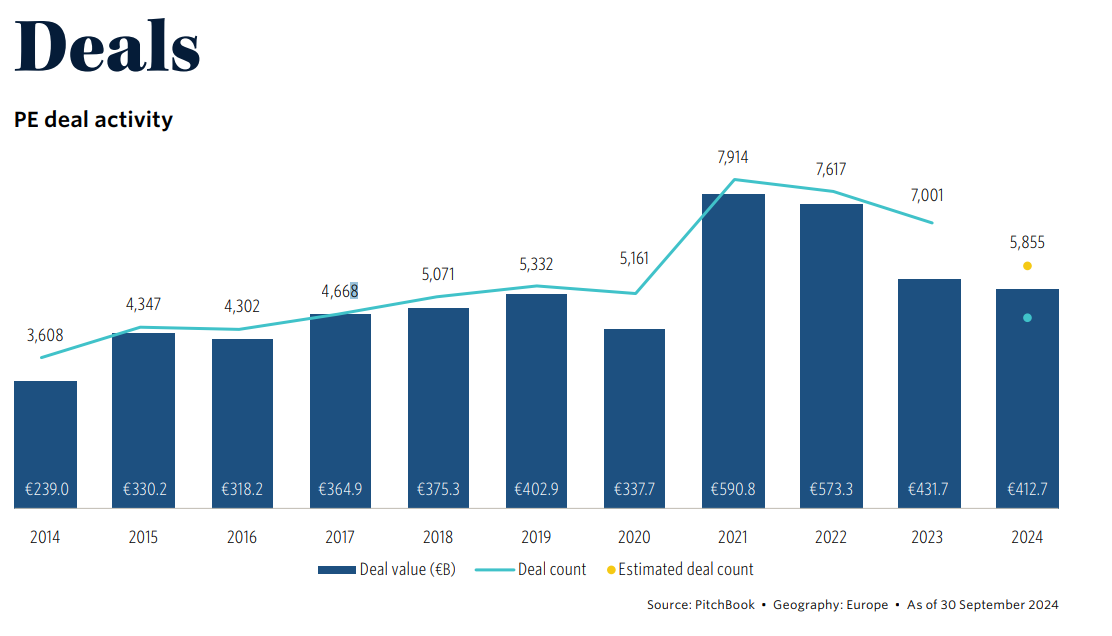

As we previously mentioned, research from Pitchbook reveals that 2024 is projected to witness a considerable surge in deal activity, with an anticipated 27.5% YoY growth in deal value and 11.5% in deal count. This promising outlook is supported by narrowing bid-ask spreads fostering common ground for buyers and sellers, along with record levels of ready finances among sponsors. According to world bank, these factors are likely to stimulate increased capital deployment, particularly as market conditions improve.

European central banks are reducing interest rates as inflation targets stabilise. These monetary policies significantly impact PE deal making from borrowing capabilities to market sentiment. Despite running a few months behind public markets, private markets are showing signs of recovery with a 27.5% YoY growth in deal value and 11.5% in deal count. As rates continue to drop, bid-ask spreads are closing, enabling better capital deployment. With sponsors at near-record dry powder levels, market conditions are becoming increasingly favourable for intensified capital deployment in 2025.

Megadeals are surging

The Market sentiment has shown considerable improvement this year, with an increase of 40% in the median deal size compared to 2023. 2024 has already surpassed the previous year by 24.5% in deals over €2.5 billion value. Interestingly, there's a surge in buyout deals, whereas growth/expansion deals have declined. Overall, the appetite for megadeals has made a strong comeback across all types.

More IPOs are needed for a recovery

The European exit landscape remains sparse, with exit value expected to finish flat YoY, marking a 34.3% decrease from the 2021 high. While H1 saw successful IPOs from companies like CVC, Galderma, and Douglas, about half of these are currently trading below their IPO price, an unfavourable sign for sponsors aiming to exit. With the STOXX Europe 600 index up by 9.3% YTD, a recovery within exits necessitates a few more major IPOs to perform well. Despite 2024 YTD reflecting a megaexit count aligned with 2023 levels, these deals tend to be slightly smaller, resulting in trailing mega exit value and a drop in average and median exit value this year compared to last year.

Exits to sponsors overtake exits to corporates

This year has seen a shift in exit strategies, with more exits to sponsors than corporate acquisitions for the first time since 2014. Sponsors accounted for over 50% of exit count year-to-date, making up 47.1% of exit value. This rise can be attributed to high levels of dry powder, resulting in aggressive deployment by PE firms, often in the form of sponsor-to-sponsor deals. Providence Equity Partners' sale of a 50% stake in Globeducate to the WendelGroup is one such example. Lower borrowing costs for sponsors have also played a role in this trend. While sponsor acquisitions are expected to remain steady in count and value, corporate acquisitions are predicted to decrease by a third.

Growth/expansion funds are falling out of favour

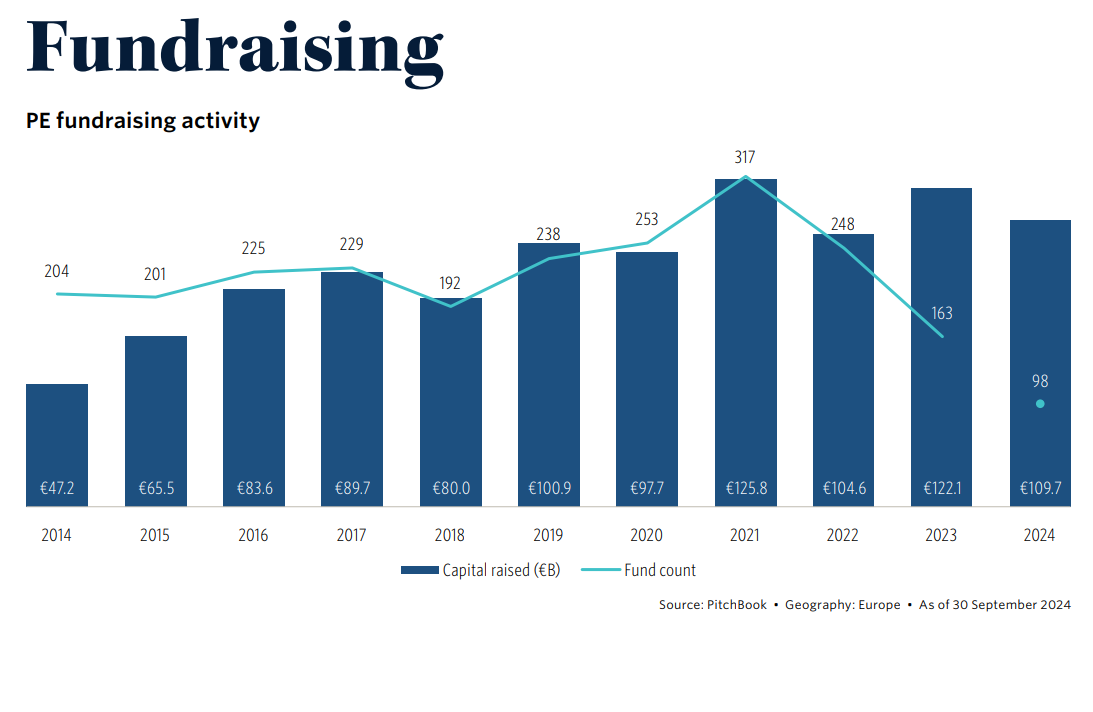

European funds have demonstrated resiliency, raising €110 billion in new capital in the first nine months of 2024, with fundraising remaining robust despite various macroeconomic factors. However, Q3 showed a decrease in fundraising compared to the two previous quarters. The largest fund was the European Private Investment Club III with €2 billion. Two other funds exceeding €1 billion were also closed in Q3: Inflexion Enterprise IV and Tenzing Private Equity III. Growth strategies are losing market share to traditional buyout funds, with PE growth/expansion funds now accounting for less than 10% of European PE capital YTD. Since 2021, a change is noticed in investment focus from growth-centric towards a balanced approach prioritising profitability and balance-sheet management within growth funds.

Are you a fund looking for a heavy weight CFO or finance leader for your investor-led business?

Marks Sattin's Executive Search team works with a wide range of investor-led and privately-owned businesses across all sectors and locations. With over 30 years of experience, we have helped a number of organisations find their next CFO. If you would like to speak to us about hiring a CFO for your portfolio or your owner-managed business, please don’t hesitate to submit a brief.