Distressed debt players seek opportunity as recession fears fade

Over the past year we have extensively discussed the latest trends in the investment market and what this means for investment-led businesses. Thus, the latest article from Pitchbook, combined with increasing confidence in the wider economy is a welcomed turn in conditions for the Financial Services sector. According to Pitchbook’s latest analyst note, the equity markets are sailing towards all-time highs first reached in late 2021.

But this change in fortunes has left distressed debt investors scratching their heads. As recently as December 2022, many distressed and credit players expected to see a weakening US economy and lower asset prices this year. However, this has not materialised.

The impact of high interest rates

In the US, the fed fund rate has not been above 5.25% since the 1990s, but that level is now the lower bound of the Federal Reserve’s target rate. These historically high rates have so far failed to slow the consumer, the economy or the increase in asset prices, all the while core inflation remains more than double the Fed’s preferred level.

Furthermore, the impact of interest hikes is unusually delayed. Although central banks in the United States and Europe have raised interest rates at the fastest pace in decades to tame inflation, most economies have so far escaped the painful recessions triggered by previous tightening cycles.

It appears that the high interest rates are here to stay too, with French central bank governor Francois Villeroy de Galhau saying that in the eurozone, the peak is near after a combined four percentage points increase in the past year. He also added that rates would be left high for as long as necessary to ensure inflation returns to the European Central Bank’s 2% target by 2025.

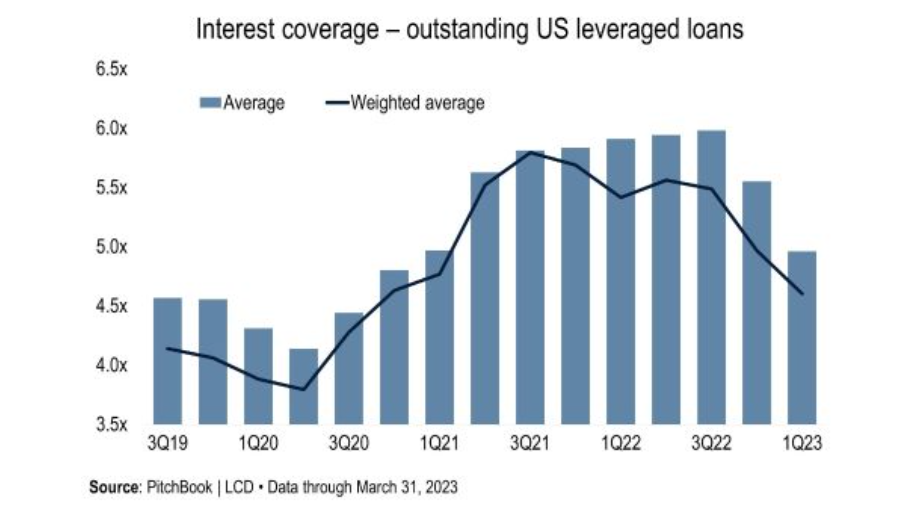

The impact of rising rates on interest coverage

In the US, leveraged loan interest coverage topped 5.5x in 2022. But with short-term rates climbing and earnings projections falling, it has since tumbled.

This combined with the private credit market’s interest coverage ratio is incredibly troubling. This risky starting point, at some 2x or less, it’s just half the ratio in the speculative-grade debt markets. Moreover, the increasing default rates for high-yield bonds and leveraged loads also demand investor attention.

But what does this all mean for distressed debt investors?

Despite the negativity in the market, the rallying is not a surprise to everyone. The recent rally in debt and equity markets is also bolstered by the positive economic data coming out of a variety of sources. For instance, payroll employer numbers are up significantly from a year ago, encouraging signs that the labour market is recovering. US housing and manufacturing have both shown recent improvement, while consumer spending has largely remained steady throughout this period.

While inflation could mean rising costs for consumers, it is also an indication that the economy is improving, and consumer demand remains strong. This helps explain why many investors remain bullish on equities and other risk assets despite some signs of a slowing in economic growth. In short, it appears that the markets are holding up well in the face of uncertain economic conditions.

Sectors to watch

Investors must be wary of “profits in the rear view mirror” businesses, where earnings have been good in the past but are likely to suffer going forward. A key example of this is retail and oil related services companies, especially those that have built up their fixed asset base due to rising oil prices over the past few years. companies in these sectors tend to have high debt levels.

What does this mean for those working in the sector?

We are currently working with several leading distressed and special situations funds across a variety of assets and strategies. From conversations, it is clear these organisations have an increased appetite to hire amid the market buoyancy.

Remuneration packages in this area, including bonus, are on a sharp incline. This is primarily due to the chronic shortage of talent in the space.

How Marks Sattin can help you find your next investment management hire

Our Fund Finance Consultants have a legacy of working with distressed and special situation funds. We have worked with boutique firms growing out Fund Finance and Ops professionals in this space. Similarly, we have been able to offer consultancy and market insights to the larger players allocating major investment into this strategy. Our ingrained background in the Fund Finance space has enabled us to monitor this trend closely and prepare both our clients and candidates for these upcoming requirements. If you are a business looking for top-quality candidates, you can submit a brief here.

Alternatively, if you are a candidate looking for your next financial services role you can find our latest roles here.

Signup to receive the latest discipline specific articles

Related jobs

Salary:

Negotiable

Location:

London

Industry

Media & Communications

Qualification

Fully qualified

Market

Commerce & Industry

Salary

£125,000 - £175,000

Job Discipline

Qualified Finance

Contract Type:

Permanent

Description

A hospitality and entertainment brand is currently looking for a Finance Director to join their team in London (Hybrid).

Reference

BBBH184244

Expiry Date

01/01/01

Author

Charlie Buddery

Author

Charlie BudderySalary:

£67,000 - £75,000 per annum + Excellent Benefits Package

Location:

Wigan, Greater Manchester

Industry

Manufacturing

Qualification

Fully qualified

Market

Commerce & Industry

Salary

£70,000 - £80,000

Job Discipline

Qualified Finance

Contract Type:

Permanent

Description

Financial Planning and Analysis Manager for a PE backed manufacturing business based in Wigan with hybrid working paying between £67,000 - £75,000.

Reference

BBBH184364

Expiry Date

01/01/01

Author

Nathan Jones

Author

Nathan JonesSalary:

£75,000 - £85,000 per annum + Car Allowance + Benefits

Location:

Crewe, Cheshire

Industry

Transport & Logistics

Qualification

Fully qualified

Market

Commerce & Industry

Salary

£80,000 - £100,000

Job Discipline

Qualified Finance

Contract Type:

Permanent

Description

Head of Commercial Finance role for a well-established organisation based just outside of Crewe paying up to £85,000 + benefits.

Reference

BBBH183457

Expiry Date

01/01/01

Author

Nathan Jones

Author

Nathan JonesSalary:

£65,000 - £75,000 per annum + Additional Benefits Package

Location:

Cheadle, Greater Manchester

Industry

Manufacturing

Qualification

Fully qualified

Market

Commerce & Industry

Salary

£70,000 - £80,000

Job Discipline

Qualified Finance

Contract Type:

Permanent

Description

Group Reporting Manager role for a global manufacturing business based in Cheadle offering hybrid working paying between £65,000 and £75,000.

Reference

BBBH184108

Expiry Date

01/01/01

Author

Nathan Jones

Author

Nathan JonesSalary:

£40,000 - £45,000 per annum

Location:

Greater Manchester

Industry

Consumer & Retail

Qualification

Part qualified

Market

Commerce & Industry

Salary

£40,000 - £50,000

Job Discipline

Part Qualified & Transactional Finance

Contract Type:

Contract

Description

Capex Analyst | Greater Manchester | Up to £45k | Immediate Start | 6 month FTC

Reference

BBBH184360

Expiry Date

01/01/01

Author

Jamie Miller

Author

Jamie MillerSalary:

£60,000 - £65,000 per annum

Location:

Horsham, West Sussex

Industry

Technology

Qualification

None specified

Market

Commerce & Industry

Salary

£60,000 - £70,000

Job Discipline

Part Qualified & Transactional Finance

Contract Type:

Permanent

Description

Our high growth client in the tech/SAAS industry are looking for a new Finance Manager to join their growing finance team.

Reference

129384

Expiry Date

01/01/01

Author

Harry Latham

Author

Harry LathamSalary:

£60,000 - £65,000 per annum

Location:

Enfield, London

Industry

Consumer & Retail

Qualification

Finalist / Newly qualified

Market

Commerce & Industry

Salary

£60,000 - £70,000

Job Discipline

Newly Qualified Finance

Contract Type:

Permanent

Description

A fast-growing retailer and consumer goods business based in North London is looking for a new Management Accountant to join their finance team.

Reference

HLM124665

Expiry Date

01/01/01

Author

Harry Latham

Author

Harry LathamSalary:

£27,000 - £29,000 per annum

Location:

Normanton, West Yorkshire

Industry

Business Services

Qualification

None specified

Market

Commerce & Industry

Salary

£25,000 - £30,000

Job Discipline

Part Qualified & Transactional Finance

Contract Type:

Permanent

Description

Credit Controller role in Wakefield

Reference

BBBH184276

Expiry Date

01/01/01

Author

Cameron Walsh

Author

Cameron WalshSalary:

£35,000 - £38,000 per annum

Location:

Abingdon, Oxfordshire

Industry

Property and Infrastructure

Qualification

None specified

Market

Commerce & Industry

Salary

£35,000 - £40,000

Job Discipline

Part Qualified & Transactional Finance

Contract Type:

Permanent

Description

Management Accountant - Abingdon (hybrid)- £35,000 to £38,000

Reference

BBBH184350

Expiry Date

01/01/01

Author

Neil Burton

Author

Neil BurtonSalary:

£500 - £600 per day + Via Umbrella

Location:

London

Industry

Investment Banking & Capital Markets

Qualification

Fully qualified

Market

Financial Services

Salary

£350 - £450

Job Discipline

Qualified Finance

Contract Type:

Contract

Description

Interim Finance Business Partner - 6 Month Contract Location: London (Hybrid) Salary: £500 - £600 per day via umbrella - Banking FP&A experience Required!

Reference

BBBH184347

Expiry Date

01/01/01

Author

Deem NaPattaloong

Author

Deem NaPattaloong