The latest trends in the US private equity market

Much like in the European private equity market, investment activity in the US is at reduced levels. Pitchbook, a leading provider of public and private capital market data, has helpfully written a comprehensive overview broadly summarising private equity (PE) activity in the US.

In response to this, we have written a three part-series breaking down activity in the country. Part one of the series focuses the broad trends sweeping the US PE market, section two will discuss the impact of slower PE exit timelines and the impending maturity wall, and the final segment will review PE fundraising activity and performance.

Key macro-PE trends in the US

- Deal-making in a downturn

H1 of 2023 played out in a similar fashion to H2 2022 across the US PE and wider investment market. Persistently high interest rates have proven to cause challenges for funds as they mean the cost of borrowing, and servicing floating rate debt is prohibitively expensive for deals that would previously have made it over the line.

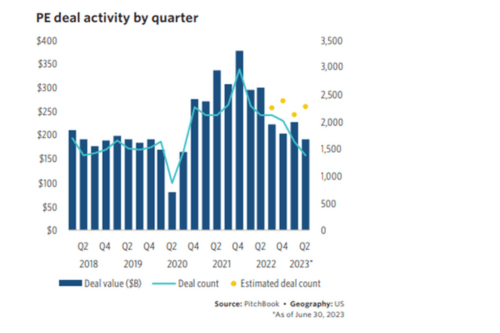

According to Pitchbook, deployment remains down by 49.2% from the quarterly peak reached in Q4 2021, and realizations are down by 67.6% from the Q2 2021 peak. To compound this, fund performance, whilst still ahead of most asset classes and strategies on a ten-year basis, has fallen to the middle of the pack on a one-year horizon basis. As a result, fundraising continues to be more difficult and is tracking 15%-25% below 2022’s first half, although other strategies such as venture and real assets have fallen hastily.

- The impact of the Silicon Valley Bank failure

The seminal event of H1 2023 was the collapse of Silicon Valley Bank (SVB) and the mini banking crisis which followed. The impact on the PE market was small, with four take-privates announced in the immediate weeks which followed. However, the crisis created a risk-averse environment for lenders. The collapse of SVB was sudden and the full fall out from this is only just being understood.

- Public markets have rebounded

According to Pitchbook, as of June 30, the S&P 500 was up by 17.6% on a one-year basis, in stark contrast to the 18.1% one-year negative return just six months prior. And at the time of writing (July 24, 2023) the S&P 500 is continued to rise buy a further 4.79%.

The negative denominator effect, how volatility and turmoil in the public markets impact fundraising in the private markets, is not as clear, and allocators have breathing room to distribute more to PE or stay the course.

- The rise of leveraged buyouts

A further change and in the US investment market is that big banks have slowly waded back into the leveraged buyout (LBO) market. After taking an eight-month sabbatical on making any new commitments to large take privates, a trickle of new leveraged loan deals was announced in Q1 2023 and picked up steam in Q2.

Private credit funds continued to lend all along and were the main reason the LBO market and PE deal flow, in general, did not collapse coming out of the steepest rate hikes in more than 40 years. Instead, the industry has maintained pre-COVID-19 levels of deal activity, which used to be considered strong years before the 2020 to 2021 frenzy set the bar impossibly high.

US Private Equity deal trends in H1 2023

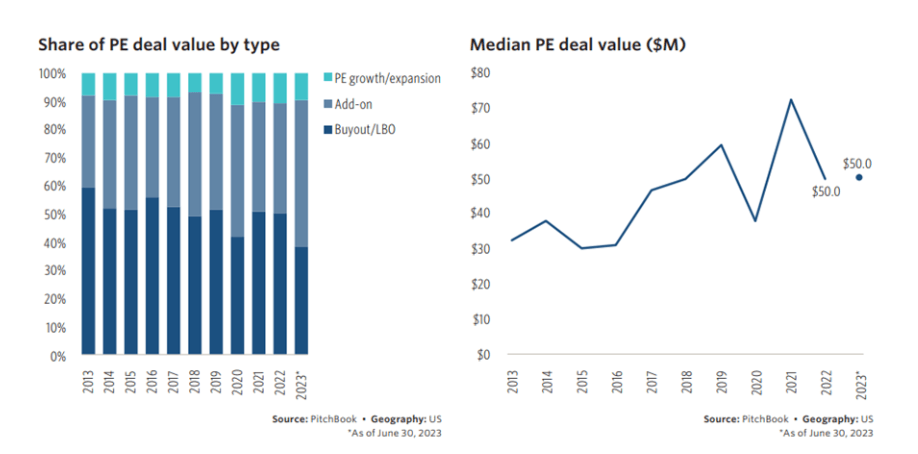

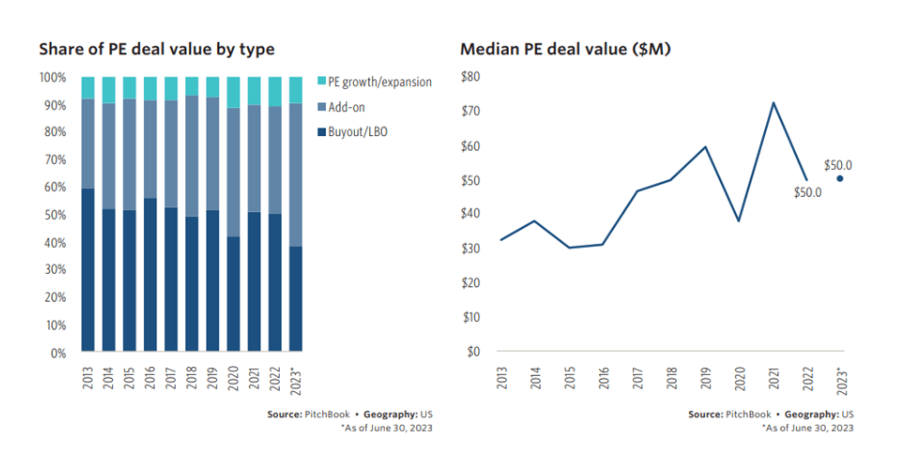

Deal making has been trending downwards for the past six quarters, with Q2 2023 being a mixed bag. Despite deal count increasing slightly, deal value declined by 15.8% from Q1. There are limited signs that the market is going to stabilise in the next three months, but with, deal-making is holding above pre-COVID levels by 56.3%.

- Alternative funding routes

Investors have recalibrated during this downward period to get deals over the line and to keep LBOs moving. Nominally, the size of deals has got smaller, making them easier to finance. Data suggests that the trend we have seen in Europe, wherein add-ons account for a considerable proportion of deals, is also seen across the Atlantic. As a result, the leveraged loan market is still open for sponsor-backed businesses wanting to do add-ons.

Another source of credit for add-ons is net asset value (NAV) financing. Instead of using an individual company as collateral, these lenders use the NAV across a portfolio of companies held by a fund. This further explains why add-on dealmaking is so frenzied, as sponsors see it to fix up portfolios in advance of selling these platform companies further down the road, and every bit of leverage counts. The NAV finance market is estimated to have grown by 50% in 2022.

- Smaller deals

Large LBOs are normally the foundation of take private deals, but even these have got smaller over past twelve months. More than half the take privates in the US YTD have been worth less than $1billion in size. With that being said, the number of take-privates announced in the past quarter has picked up pace.

- The rise of growth equity deals

Moreover, the US market has also seen a significant increase in in growth equity deals, as they do not rely on debt, thus investors are not at the mercy of interest rates. Growth equity deals depend on the PE firm’s ability to apply active management to augment company growth and boost returns via operational leverage in place of financial influence. In the first half of 2023, these deals accounted for 10% of total deal activity in the US, and we expect this trend to continue upwards.

These trends are examples of how PE, and the wider investment market, has adapted to rising interest rates: keep deals small and find alternative sources of capital to fill gaps.

Valuation trends in the US Private Equity market

- Valuations trend higher in the US than in Europe

PE disclosure rates on private companies in the US are significantly lower than in Europe, this means that meaningful analysis on valuation trends is difficult as the datasets are so thin. The US valuation data available trends towards large take-privates, which means the prices paid skew higher than Europe by 25-30%.

- Technology, Healthcare and Financial Services

Around the world PE firms naturally gravitate towards the tech, healthcare, and financial services sectors. However, in the US, they have remained particularly buoyant, despite the wider PE trends. Healthcare in particular has shown particular resilience.

- Take privates

Taking public companies private continues to be a highly popular strategy for PE. A total of forty-three take-privates have been announced or completed so far in 2023, identical to last year, which, according to Pitchbook, went on to record the highest take-private deal value in 15 years.

- Reduced deal sizes have resulted in lower deal value

Deal sizes have contracted significantly due to the constrained lending environment for big LBOs. According to Pitchbook, the median deal size of 2023’s crop is $482.9 million, which compares with a median of $1.7 billion during the same span last year, dropping the combined value of take-private deals to $88.9 billion YTD versus $147.2 billion YTD in 2022. While down from H1 2022, this year’s activity marks a re-acceleration from H2 2022 when take privates slowed to just 32 deals and $44.8 billion in value.

- Add-ons

Add-ons are at the core of the PE buy-and-build playbook, and their share of all PE buyouts has risen steadily every year. A well-executed add-on can supply revenue and cost synergy that accelerates the top and bottom line for the acquiring platform company and creates value for the PE owner and potential buyer down the road.

Historically, add-ons have always been easy to finance, but in 2022 and so far in 2023, growth has been off the charts. In the US, add-ons as a share of all buyouts expanded by nearly four full percentage points in 2022 from 72.5% in 2021 to 76.5% before adding another point-and-a-half in the first six months of 2023 to stand at 78.0% currently.

Add-ons have been instrumental in keeping the PE wheel spinning during this period of tight credit and market dislocation. They allow PE sponsors to continue deploying capital while taking down deal size and biding time until lending markets can support larger platform buyouts.

- What does this mean for investor-led businesses in the US

It is clear from Pitchbook’s report that PE firms have kept buying, building and selling despite the tough lending environment. The macro trends that we are seeing in Europe are also translating to the US market, albeit on a larger scale.

We’re anticipating that the core market trends of:

- Taking companies private

- Finding alternative funding routes

- And reduced deal size and value will continue to trend in investors favour.

Find your next investor-led CFO or Executive Finance role with Marks Sattin Executive Search

At Marks Sattin Executive Search, we work with a wide range of investor-led and privately owned businesses across all sectors and locations. With over 30 years of experience, we have helped more than several professionals find their next exciting opportunity in private equity.

Apply for an available CFO or Executive Finance job with us today or register your details to shortlist

Signup to receive the latest discipline specific articles

Related jobs

Salary:

Equity, Bonus and Benefits

Location:

London

Industry

Healthcare

Qualification

Fully qualified

Market

Executive Search

Salary

£125,000 - £175,000

Job Discipline

Private Equity Executive Search

Contract Type:

Permanent

Description

Marks Sattin Executive Search is partnering with a dynamic, PE-backed Multisite Healthcare Services business to recruit a CFO.

Reference

TA 3429

Expiry Date

01/01/01

Author

Executive Search

Author

Executive SearchSalary:

£100,000 - £120,000 per annum + bonus and benefits

Location:

Crawley, West Sussex

Industry

Business Services

Qualification

Fully qualified

Market

Executive Search

Salary

£100,000 - £125,000

Job Discipline

Private Equity Executive Search

Contract Type:

Permanent

Description

Marks Sattin Executive Search is working with a rapidly growing PE-backed buy-and-build B2B business

Reference

TA 3431

Expiry Date

01/01/01

Author

Executive Search

Author

Executive SearchSalary:

£160,000 - £180,000 per annum + Equity, Bonus and Benefits

Location:

North West England

Industry

Education

Qualification

Fully qualified

Market

Executive Search

Salary

£175,000 - £250,000

Job Discipline

Private Equity Executive Search

Contract Type:

Permanent

Description

Marks Sattin Executive Search is currently working with a PE-Backed Education Business seeking an experienced CFO

Reference

TA 3430

Expiry Date

01/01/01

Author

Executive Search

Author

Executive SearchSalary:

£100,000 - £120,000 per annum + bonus and benefits

Location:

Crawley, West Sussex

Industry

Business Services

Qualification

Fully qualified

Market

Executive Search

Salary

£100,000 - £125,000

Job Discipline

Private Equity Executive Search

Contract Type:

Permanent

Description

Marks Sattin Executive Search is working with a rapidly growing PE-backed buy-and-build B2B business

Reference

TA 3428

Expiry Date

01/01/01

Author

Executive Search

Author

Executive SearchSalary:

£160,000 - £180,000 per annum + Equity, Bonus and Benefits

Location:

North West England

Industry

Education

Qualification

Fully qualified

Market

Executive Search

Salary

£175,000 - £250,000

Job Discipline

Private Equity Executive Search

Contract Type:

Permanent

Description

Marks Sattin Executive Search is currently working with a PE-Backed Education Business seeking an experienced CFO

Reference

TA 3427

Expiry Date

01/01/01

Author

Executive Search

Author

Executive SearchSalary:

Equity, Bonus and Benefits

Location:

London

Industry

Healthcare

Qualification

Fully qualified

Market

Executive Search

Salary

£125,000 - £175,000

Job Discipline

Private Equity Executive Search

Contract Type:

Permanent

Description

Marks Sattin Executive Search is partnering with a dynamic, PE-backed Multisite Healthcare Services business to recruit a CFO.

Reference

TA 3426

Expiry Date

01/01/01

Author

Executive Search

Author

Executive SearchSalary:

£100,000 - £120,000 per annum + bonus and benefits

Location:

Crawley, West Sussex

Industry

Business Services

Qualification

Fully qualified

Market

Executive Search

Salary

£100,000 - £125,000

Job Discipline

Private Equity Executive Search

Contract Type:

Permanent

Description

Marks Sattin Executive Search is working with a rapidly growing PE-backed buy-and-build B2B business

Reference

TA 3425

Expiry Date

01/01/01

Author

Executive Search

Author

Executive SearchSalary:

£160,000 - £180,000 per annum + Equity, Bonus and Benefits

Location:

North West England

Industry

Education

Qualification

Fully qualified

Market

Executive Search

Salary

£175,000 - £250,000

Job Discipline

Private Equity Executive Search

Contract Type:

Permanent

Description

Marks Sattin Executive Search is currently working with a PE-Backed Education Business seeking an experienced CFO

Reference

TA 3424

Expiry Date

01/01/01

Author

Executive Search

Author

Executive SearchSalary:

Equity, Bonus and Benefits

Location:

London

Industry

Healthcare

Qualification

Fully qualified

Market

Executive Search

Salary

£125,000 - £175,000

Job Discipline

Private Equity Executive Search

Contract Type:

Permanent

Description

Marks Sattin Executive Search is partnering with a dynamic, PE-backed Multisite Healthcare Services business to recruit a CFO.

Reference

TA 3423

Expiry Date

01/01/01

Author

Executive Search

Author

Executive SearchSalary:

£150,000 - £175,000 per annum + bonus and equity

Location:

City of London, London

Industry

Technology

Qualification

Fully qualified

Market

Executive Search

Salary

£175,000 - £250,000

Job Discipline

Private Equity Executive Search

Contract Type:

Permanent

Description

Marks Sattin executive search is working with a dynamic and fast-growing PE-backed SaaS business poised for significant expansion.

Reference

TA 3422

Expiry Date

01/01/01

Author

Executive Search

Author

Executive Search