The latest in European Private Equity in Q2 2023

As we discussed in our previous article, Europe has experienced significant economic and political challenges in the past eighteen months. However, the EU economy has continued to show resilience in this difficult global context.

Lower energy prices, abating supply constraints and a strong labour market supported moderate growth in the first quarter of 2023, dispelling fears of a recession. This better-than-expected start to the year lifts the growth outlook for the EU economy to 1.0% in 2023 and upward revisions now putting GDP growth now expected at 1.1% and 1.6% in 2023 and 2024, respectively.

But has this translated to a more favourable PE deal making environment?

To answer this question, we have reviewed Pitchbook’s latest in European PE.

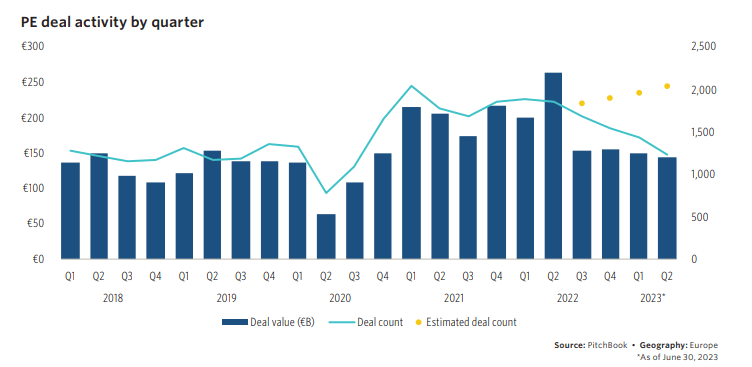

But it is not all bad news. PE deal value in Q2 has not declined as sharply and is showing considerable resilience. According to Pitchbook, overall activity for 2023 to remain depressed given tougher macroeconomic conditions and higher financing costs seen so far. However, as an asset class, there may be more resilience in PE deal activity as industry players weigh in on depressed asset valuations.

Moreover, much like we predicted in January, take-privates have proven to be a popular options with investors, with smaller transactions and add-ons continuing to take a greater share of deal value from megadeals.

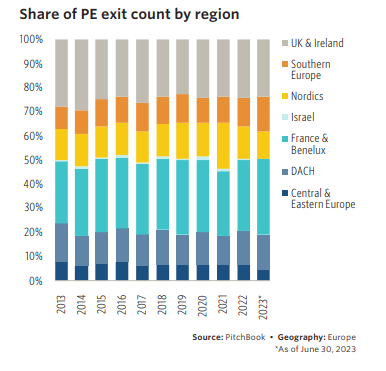

PE exit value showing positive signs

Exit value was fuelled by a disproportionally high number of mega-exits above €2.5 billion, which more than doubled from Q1 to Q2 in 2023. Investors have been exiting their large investments to free up capital and to rebalance their portfolios in response to the denominator effect.

Furthermore, European exits were also fuelled by corporate acquisitions, which went from representing 28.1% of exit value in Q2 2022 to representing 64.1% in Q2 2023. This rise in favour of acquisitions over the past year has coincided with the European Central Bank’s (ECB’s) tightening monetary policy, which started in July 2022.

Additionally, with interest rates rising, leveraged buyouts (LBOs) have become costlier and have thus fallen out of favour. This is a particularly interesting development as it initially appeared as though the macroeconomic adversities would completely bypass the mid-cap leveraged finance market. But what was foreshadowed in the final quarter of 2022 has been confirmed in the first quarter of this year: Inflation and rising interest rates are making private equity investors, banks, and debt funds more cautious about financing mid-cap LBOs in Europe.

PE fundraising: Megafunds are living up to their name

According to Pitchbook, PE fundraising levels in 2023 are on track to exceed those of 2022.

Several large deals closed in Q2, with more large, open funds likely to boost totals if also closed this year. Larger funds continue to take capital from smaller vehicles. However, the environment is still tough, with time to close markedly stepping up this year versus in 2022. Despite this, and given resilient levels of activity in H1 2023, we expect PE fundraising to remain well-placed through the year.

Find your next investor-led CFO or Executive Finance role with Marks Sattin Executive Search

Signup to receive the latest discipline specific articles

Related jobs

Salary:

£100,000 - £120,000 per annum + bonus and benefits

Location:

Crawley, West Sussex

Industry

Business Services

Qualification

Fully qualified

Market

Executive Search

Salary

£100,000 - £125,000

Job Discipline

Private Equity Executive Search

Contract Type:

Permanent

Description

Marks Sattin Executive Search is working with a rapidly growing PE-backed buy-and-build B2B business

Reference

TA 3428

Expiry Date

01/01/01

Author

Executive Search

Author

Executive SearchSalary:

£160,000 - £180,000 per annum + Equity, Bonus and Benefits

Location:

North West England

Industry

Education

Qualification

Fully qualified

Market

Executive Search

Salary

£175,000 - £250,000

Job Discipline

Private Equity Executive Search

Contract Type:

Permanent

Description

Marks Sattin Executive Search is currently working with a PE-Backed Education Business seeking an experienced CFO

Reference

TA 3427

Expiry Date

01/01/01

Author

Executive Search

Author

Executive SearchSalary:

Equity, Bonus and Benefits

Location:

London

Industry

Healthcare

Qualification

Fully qualified

Market

Executive Search

Salary

£125,000 - £175,000

Job Discipline

Private Equity Executive Search

Contract Type:

Permanent

Description

Marks Sattin Executive Search is partnering with a dynamic, PE-backed Multisite Healthcare Services business to recruit a CFO.

Reference

TA 3426

Expiry Date

01/01/01

Author

Executive Search

Author

Executive SearchSalary:

£100,000 - £120,000 per annum + bonus and benefits

Location:

Crawley, West Sussex

Industry

Business Services

Qualification

Fully qualified

Market

Executive Search

Salary

£100,000 - £125,000

Job Discipline

Private Equity Executive Search

Contract Type:

Permanent

Description

Marks Sattin Executive Search is working with a rapidly growing PE-backed buy-and-build B2B business

Reference

TA 3425

Expiry Date

01/01/01

Author

Executive Search

Author

Executive SearchSalary:

£160,000 - £180,000 per annum + Equity, Bonus and Benefits

Location:

North West England

Industry

Education

Qualification

Fully qualified

Market

Executive Search

Salary

£175,000 - £250,000

Job Discipline

Private Equity Executive Search

Contract Type:

Permanent

Description

Marks Sattin Executive Search is currently working with a PE-Backed Education Business seeking an experienced CFO

Reference

TA 3424

Expiry Date

01/01/01

Author

Executive Search

Author

Executive SearchSalary:

Equity, Bonus and Benefits

Location:

London

Industry

Healthcare

Qualification

Fully qualified

Market

Executive Search

Salary

£125,000 - £175,000

Job Discipline

Private Equity Executive Search

Contract Type:

Permanent

Description

Marks Sattin Executive Search is partnering with a dynamic, PE-backed Multisite Healthcare Services business to recruit a CFO.

Reference

TA 3423

Expiry Date

01/01/01

Author

Executive Search

Author

Executive SearchSalary:

£150,000 - £175,000 per annum + bonus and equity

Location:

City of London, London

Industry

Technology

Qualification

Fully qualified

Market

Executive Search

Salary

£175,000 - £250,000

Job Discipline

Private Equity Executive Search

Contract Type:

Permanent

Description

Marks Sattin executive search is working with a dynamic and fast-growing PE-backed SaaS business poised for significant expansion.

Reference

TA 3422

Expiry Date

01/01/01

Author

Executive Search

Author

Executive SearchSalary:

£160,000 - £180,000 per annum + Equity, Bonus and Benefits

Location:

North West England

Industry

Education

Qualification

Fully qualified

Market

Executive Search

Salary

£175,000 - £250,000

Job Discipline

Private Equity Executive Search

Contract Type:

Permanent

Description

Marks Sattin Executive Search is currently working with a PE-Backed Education Business seeking an experienced CFO

Reference

TA 3421

Expiry Date

01/01/01

Author

Executive Search

Author

Executive SearchSalary:

£100,000 - £120,000 per annum + bonus and benefits

Location:

Kent

Industry

Business Services

Qualification

Fully qualified

Market

Executive Search

Salary

£100,000 - £125,000

Job Discipline

Private Equity Executive Search

Contract Type:

Permanent

Description

Marks Sattin Executive Search is working with a rapidly growing PE-backed buy-and-build B2B business

Reference

TA 3420

Expiry Date

01/01/01

Author

Executive Search

Author

Executive SearchSalary:

Equity, Bonus and Benefits

Location:

London

Industry

Healthcare

Qualification

Fully qualified

Market

Executive Search

Salary

£125,000 - £175,000

Job Discipline

Private Equity Executive Search

Contract Type:

Permanent

Description

Marks Sattin Executive Search is partnering with a dynamic, PE-backed Multisite Healthcare Services business to recruit a CFO.

Reference

TA 3419

Expiry Date

01/01/01

Author

Executive Search

Author

Executive Search