Exit timelines and the impending maturity wall in the US private equity market

Post-pandemic the US private markets enjoyed an extended period of bullish conditions, setting records for investment activity. After the initial onset of the COVID-19 pandemic, private equity (PE) activity in the US went from strength to strength. This was primarily down to an abundance of cheap capital and funds wanting to diversify assets. During this period, US PE set new records in 2021, as deal value soared by 86.6% to reach $1.3 trillion and deal count jumped by 53.1% to 9,286 deals.

However, what goes up, must come down.

Like many industries, the PE investment market has been deeply impacted by rising interest rates and high inflation. And whilst deal activity fell from its peak, exits have dropped even more abruptly and have been suffering ever since.

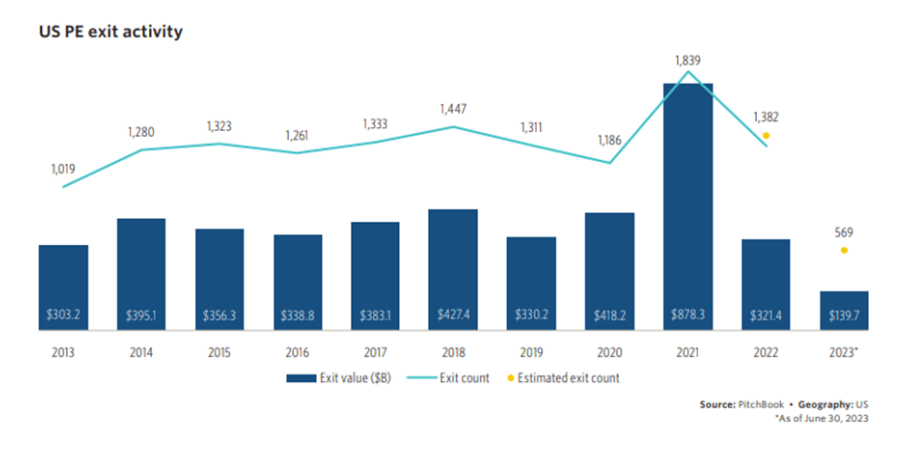

Exit value in US PE

Quarterly exit value was flat to down for seven consecutive quarters starting in Q3 2021 and declined significantly throughout 2022, as sponsors continue to struggle against unfavourable valuation adjustments, a much slowed IPO market, an uncertain economic outlook.

By the end of Q1 2023, quarterly exit value in the US was down 75.1% from the peak in Q2 2021. According to Pitchbook, quarterly exit activity is now well below the pre-COVID (2017 to 2019) median with no signs of bottoming, which indicates to us that a new normal is firmly in place. Even if the market rebounds to the pre-COVID norm, the PE industry is running out of time to complete an orderly disposition of portfolio holdings within the time frames initially allotted to its funds.

Why does this matter?

A typical buyout fund has a lifespan of approximately 10 years, with many PE funds starting to exit their successful assets earlier, around the five- or even three-year mark.

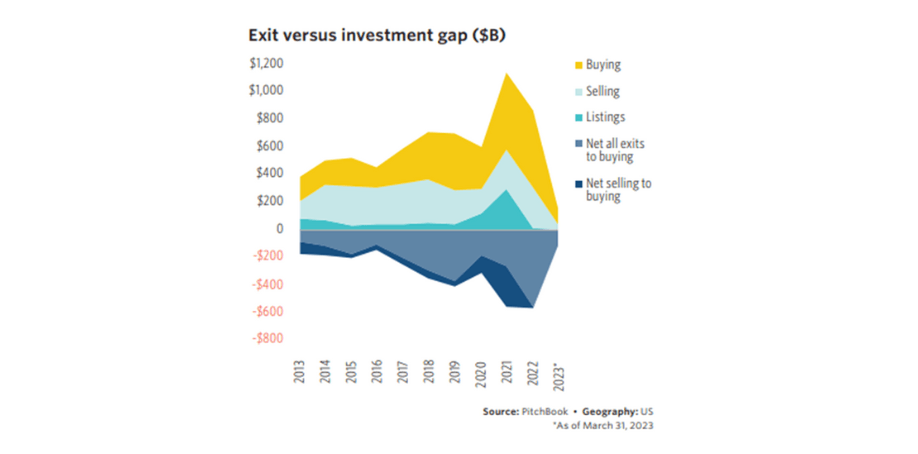

The current weakness in exit activity is creating a gap between the two flows of capital:

- While deal activity soldiers on, exit pacing has slowed as General Partners (GPs) hold onto their portfolio companies longer to allow for valuations to recover to their liking or grow revenues and EBITDA to compensate for lower multiples.

- The significantly fatigued exit market means an impending “maturity wall” looms in the PE industry for deals made five to seven years ago that are beginning to reach their natural exit timelines.

However, exit activity expected to remain stunted for the foreseeable future as investors continue to face macroeconomic headwinds. As a result, GPs will need to address the incoming maturity wall of investments. The investments made during the bullish deal environment of the last 10 years are now due to be exited in a much-changed environment, and investors must adjust their strategies.

US PE exit activity and the impeding maturity wall

It is worth noting that PE exit activity recovered slightly in Q2 2023, a welcome break from the three consecutive quarters of decline.

The current weakness in exit activity means that a maturity wall is fast approaching for the PE funds nearing the end of their term life to distribute their capital back to investors through exits. With the new normal of slow exit activity is expected to continue, investors could be faced with an enormous pileup of deals that are either unable to sell or are being held for longer than expected because of lower valuations. Even when we assume exit activity to revert to pre-COVID-19 levels, which is unlikely given the current macroeconomic trends, PE firms are expected to fall behind on their exit timelines.

Much like in Europe, exits via public listings has remained cool throughout PE. However, indicators in the market and wider analysis from Pitchbook indicates that IPOs could recover in the second half of 2023. However, any recovery in the IPO markets is subject to market volatility and there is still too much change to make an informed predication on the next steps.

Similarly, sponsor-to-sponsor exit activity declined sharply due to compounding market challenges. PE firms in Q2 2023 remained cautious with sponsor-to-sponsor dealmaking, which led to reduced transactions between sponsors, and disruptions in the lending market limited GPs’ ability to absorb sizable deals.

Conversely, exits to corporates has picked up considerably in Q2 2023, and accounts for around 65% of total PE exit value. But whilst exit value to corporates is steadily rising, exit count is at record lows. However, this is representative of the wider trends in the PE market which we discussed in an earlier article on US PE trends.

In terms of B2B exits, the trends we are seeing here match with the wider PE landscape, with deal value declining. However, if you view B2B exits in isolation, they are performing relatively well, with YTD PE exit value share above the average of what we have seen in the past five years.

The impending maturity wall

To determine the approaching maturity wall, we must examine the capital raised by funds that are reaching the end of their 12-year term. Funds that closed in 2016 will hit their term in 2028, and the capital raised in 2016 that has yet to be distributed back to investors through exits will be the amount hitting the maturity wall.

Industry to watch: Oil and Gas

Corporates in the oil and gas industry have shown there is considerable appetite for acquisitions. Some of the most noteworthy exit activity has been in this sector. This growth has primarily been driven by the need for corporates to consolidate supply chains and diversify their supplies.

A prominent example of this was ONEOK announcing it would acquire PE-backed Magellan Midstream Partners for $18.8 billion. The merger will result in one of the biggest oil and gas infrastructure companies in North America and will enhance the company’s presence in sustainable fuel and hydrogen corridors for further opportunities in energy transition.

Find your next CFO or Executive Finance role with Marks Sattin Executive Search

At Marks Sattin Executive Search, we work with a wide range of investor-led and privately owned businesses across all sectors and locations. With over 30 years of experience, we have helped a number of organisations find exceptional executive finance talent.

If you would like to know how we can help your business, please don’t hesitate to contact me.

Signup to receive the latest discipline specific articles

Related jobs

Salary:

Equity, Bonus and Benefits

Location:

London

Industry

Healthcare

Qualification

Fully qualified

Market

Executive Search

Salary

£125,000 - £175,000

Job Discipline

Private Equity Executive Search

Contract Type:

Permanent

Description

Marks Sattin Executive Search is partnering with a dynamic, PE-backed Multisite Healthcare Services business to recruit a CFO.

Reference

TA 3429

Expiry Date

01/01/01

Author

Executive Search

Author

Executive SearchSalary:

£100,000 - £120,000 per annum + bonus and benefits

Location:

Crawley, West Sussex

Industry

Business Services

Qualification

Fully qualified

Market

Executive Search

Salary

£100,000 - £125,000

Job Discipline

Private Equity Executive Search

Contract Type:

Permanent

Description

Marks Sattin Executive Search is working with a rapidly growing PE-backed buy-and-build B2B business

Reference

TA 3431

Expiry Date

01/01/01

Author

Executive Search

Author

Executive SearchSalary:

£160,000 - £180,000 per annum + Equity, Bonus and Benefits

Location:

North West England

Industry

Education

Qualification

Fully qualified

Market

Executive Search

Salary

£175,000 - £250,000

Job Discipline

Private Equity Executive Search

Contract Type:

Permanent

Description

Marks Sattin Executive Search is currently working with a PE-Backed Education Business seeking an experienced CFO

Reference

TA 3430

Expiry Date

01/01/01

Author

Executive Search

Author

Executive SearchSalary:

£100,000 - £120,000 per annum + bonus and benefits

Location:

Crawley, West Sussex

Industry

Business Services

Qualification

Fully qualified

Market

Executive Search

Salary

£100,000 - £125,000

Job Discipline

Private Equity Executive Search

Contract Type:

Permanent

Description

Marks Sattin Executive Search is working with a rapidly growing PE-backed buy-and-build B2B business

Reference

TA 3428

Expiry Date

01/01/01

Author

Executive Search

Author

Executive SearchSalary:

£160,000 - £180,000 per annum + Equity, Bonus and Benefits

Location:

North West England

Industry

Education

Qualification

Fully qualified

Market

Executive Search

Salary

£175,000 - £250,000

Job Discipline

Private Equity Executive Search

Contract Type:

Permanent

Description

Marks Sattin Executive Search is currently working with a PE-Backed Education Business seeking an experienced CFO

Reference

TA 3427

Expiry Date

01/01/01

Author

Executive Search

Author

Executive SearchSalary:

Equity, Bonus and Benefits

Location:

London

Industry

Healthcare

Qualification

Fully qualified

Market

Executive Search

Salary

£125,000 - £175,000

Job Discipline

Private Equity Executive Search

Contract Type:

Permanent

Description

Marks Sattin Executive Search is partnering with a dynamic, PE-backed Multisite Healthcare Services business to recruit a CFO.

Reference

TA 3426

Expiry Date

01/01/01

Author

Executive Search

Author

Executive SearchSalary:

£100,000 - £120,000 per annum + bonus and benefits

Location:

Crawley, West Sussex

Industry

Business Services

Qualification

Fully qualified

Market

Executive Search

Salary

£100,000 - £125,000

Job Discipline

Private Equity Executive Search

Contract Type:

Permanent

Description

Marks Sattin Executive Search is working with a rapidly growing PE-backed buy-and-build B2B business

Reference

TA 3425

Expiry Date

01/01/01

Author

Executive Search

Author

Executive SearchSalary:

£160,000 - £180,000 per annum + Equity, Bonus and Benefits

Location:

North West England

Industry

Education

Qualification

Fully qualified

Market

Executive Search

Salary

£175,000 - £250,000

Job Discipline

Private Equity Executive Search

Contract Type:

Permanent

Description

Marks Sattin Executive Search is currently working with a PE-Backed Education Business seeking an experienced CFO

Reference

TA 3424

Expiry Date

01/01/01

Author

Executive Search

Author

Executive SearchSalary:

Equity, Bonus and Benefits

Location:

London

Industry

Healthcare

Qualification

Fully qualified

Market

Executive Search

Salary

£125,000 - £175,000

Job Discipline

Private Equity Executive Search

Contract Type:

Permanent

Description

Marks Sattin Executive Search is partnering with a dynamic, PE-backed Multisite Healthcare Services business to recruit a CFO.

Reference

TA 3423

Expiry Date

01/01/01

Author

Executive Search

Author

Executive SearchSalary:

£150,000 - £175,000 per annum + bonus and equity

Location:

City of London, London

Industry

Technology

Qualification

Fully qualified

Market

Executive Search

Salary

£175,000 - £250,000

Job Discipline

Private Equity Executive Search

Contract Type:

Permanent

Description

Marks Sattin executive search is working with a dynamic and fast-growing PE-backed SaaS business poised for significant expansion.

Reference

TA 3422

Expiry Date

01/01/01

Author

Executive Search

Author

Executive Search