Private Capital in European Football

What are MCOs?

Multi-Club Ownership structures involve one parent company owning stakes in multiple football clubs globally. These parent companies are often investment firms or conglomerates with substantial financial resources and a strong interest in football. The structure allows for cross-club collaboration, resource-sharing, and talent development between the clubs under its ownership.

So, why are investors attracted to football ownership?

Football is a multi-billion-dollar industry with a global fanbase, making it an attractive investment option for investors. Additionally, the potential returns from player transfers and sponsorships make it a lucrative business venture. Moreover, owning a football club brings with it prestige and global recognition for the investors and their parent companies.

The Impact of MCOs on Football Deal making

MCO structures have not only changed the landscape of football ownership but also impacted deal-making within the industry. With multiple clubs under one parent company, MCOs can leverage resources and negotiate better deals for players and sponsorships. This has resulted in a more competitive transfer market, with clubs under MCOs able to acquire top talent at lower costs compared to their competitors.

How does it work?

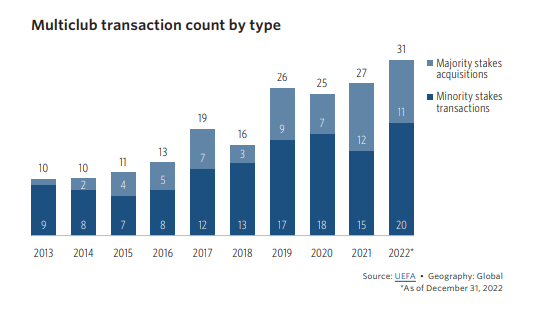

The most common structure for MCO is to own two clubs, but many owners are now looking to add further clubs. This trend has been on the rise according to UEFA, with transactions linked to MCOs more than tripling over the past decade. In 2013, there were only 10 MCOs, but by 2022, that number had risen to 31, as shown in the chart below.

One of the main reasons for this structure is that UEFA forbids two clubs owned by the same shareholders from competing in the same competition. However, this rule can be overturned in certain cases. The second reason is that the parent group will often try to replicate winning formulas from the star club to its smaller clubs, ultimately improving performance and increasing the overall group's valuation.

Another important factor is that by competing at different levels and in different geographies, the underlying MCO clubs do not directly compete against each other. This helps to avoid conflicts of interest and instead allows for collaboration between the MCO clubs.

What other sports have seen a rise in private capital investment?

Aside from owning multiple football clubs, there is also another type of MCO structure where owners diversify across sports. For example, Arsenal FC's US owner, Stan Kroenke, owns teams in the NFL, NBA, and MLS. While these portfolio assets may be uncorrelated with each other, they are all impacted by the overall performance of the MCO. This means that the success or failure of one team can affect the investment levels for all the other teams owned by the MCO.

Who are the key players?

Pitchbook’s analyst note reveals that 60% of the MCOs have US participation.

- PE Funds

Traditional PE funds have been a major source of capital injection into football in recent years. These firms, such as Ares Management and Silver Lake, typically invest through either equity or debt, with investments ranging from majority club ownership to partial stakes in operational activities like TV rights, stadium rights and sponsorship rights. This has resulted in a significant increase in the amount of financial leverage within the football industry, particularly through leveraged buyouts (LBOs) like those seen with Chelsea and Atalanta. However, minority stakes are also becoming more prevalent as these firms seek to diversify their investments and take advantage of higher industry expertise.

- Specialist sports PE funds

In addition to traditional PE firms, we have also seen the emergence of specialised sports private equity funds in recent years. These include Fenway Sports Group, 777 Partners, RedBird Capital, and MSP Sports Capital, which have all made significant investments in the sports industry. These funds tend to focus on the franchise model in US sports, which is seen as less risky than investing in European football with its higher earnings volatility. However, with the financial distress caused by Covid-19 resulting in lower valuations, these funds have also started to diversify their investments by venturing into European football.

- Other players

In addition to traditional private equity and venture capital firms, other types of investors have also been entering the football industry. This includes corporate venture capital arms (CVCs) of major corporations, hedge funds and distressed-debt investors. These types of investors may have different motivations and strategies compared to traditional private equity firms, but they also bring new sources of capital and expertise to the football industry.

Summary

As the financial landscape of football continues to evolve, it is likely that we will see more diverse types of investors entering the industry. This could lead to a shift in ownership structures and investment strategies, but it also presents opportunities for clubs to access new sources of capital and expertise. However, with this influx of new investors, it is important for football clubs to carefully consider their financial decisions and ensure they are making sustainable investments for the long-term success of the club.

Find your next investor-led CFO or Executive Finance role with Marks Sattin Executive Search

At Marks Sattin Executive Search, we work with a wide range of investor-led and privately owned businesses across all sectors and locations. With over 30 years of experience, we have helped several professionals find their next exciting opportunity in private equity.

Apply for an available CFO or Executive Finance job with us today or register your details to shortlist jobs so you never miss an opportunity.