The importance of internal audit in financial services

The financial services sector is essential to the British economy. In 2020, the sector contributed £164.8 billion to the UK economy, 8.6% of total economic output. However, like many industries, there is a shortage of talent and candidates are commanding a premium, especially in the governance, risk and audit space.

As the industry adjusts to operating in 2022, the role of internal audit is likely to come under increasing scrutiny. However, the industry cannot function without talented people in these roles. But the first barrier preventing talent from moving into these critical roles is knowledge about what internal audit actually is, their daily responsibilities, and how it differs from external audit.

What is Internal Audit?

According to the ACCA, internal auditing is the independent and objective evaluation of an organisation’s internal controls to effectively manage risk.

An Internal Auditor’s primary responsibility is to monitor and assess the governance of an institution. For the most part, this means they evaluate the effectiveness of a company’s internal controls, corporate governance, and accounting processes.

In many financial services businesses, internal audit is seen as the “third line of defence”, with compliance and risk considered the first and second line, depending on a given business. But this does not mean that audit is any less essential. Alas, the internal audit function must not only monitor compliance and transactions, but also develop an integrated view of existing and emerging risks and their impact on business. Internal audit is essential to all highly regulated businesses, as the responsibility to ensure that the first two lines are operating effectively, and suggesting improvements, falls to internal audit.

Often internal audit is tasked with utilising a risk-based approach to evaluate and report on:

- The effectiveness of governance

- Risk management

- Internal control to the organisation

Additionally, internal audit is often charged with giving assurance to sector regulators and external auditors that appropriate controls and processes are in place and functional.

In larger businesses, you may find candidates that specialise in a particular line of audit, e.g. change audit, risk audit (audit anything that the risk department does), compliance audit or IT Audit.

What do internal audit professionals do day-to-day?

An internal auditor reviews fiscal statements, expense reports, inventory, and pretty much anything requested by regulators and internal stakeholders. Everything produced by internal audit must be impeccable in case of an external audit by a governmental regulatory body. In conjunction with this, internal auditors must work closely with risk and compliance professionals to ensure the efficacy of risk management efforts. And, it goes without saying, internal audit must ensure that the organisation is complying with all relevant laws and statutes.

The function is essential for continuous improvement throughout the business. They do this by identifying shortfalls and making recommendations in line with regulations, observing macro-economic trends and adhering to industry best practice. Moreover, internal auditors often are central to business’ ESG efforts (environmental, social, governance), as they are perfectly placed to promote ethics, help identify improper conduct and investigate fraud.

What is the difference between internal and external audit:

- Internal auditors are generally internal company employees, while external auditors are always a third-party to the organisation and their clients

- Internal auditors generally do not perform a single comprehensive annual audit, but rather conduct several smaller focused internal audits throughout the year.

- Internal auditors generate reports for management, while external audit reports are prepared for use by external entities (e.g., investors, clients, lenders, and other stakeholders).

- Internal auditors can also serve as internal consultants. Conversely, external auditors are prohibited from providing attestation and consultative services to the same organisation.

Why do businesses need Internal Auditors?

Having an internal auditor or team can help the company grow, become more efficient, maintain compliance, and identify cases of fraud. Furthermore, when your external audit comes around (if you have one), having an internal auditor that has already verified the controls before the third-party steps foot in the door relieves a lot of pressure and saves a lot of time and money.

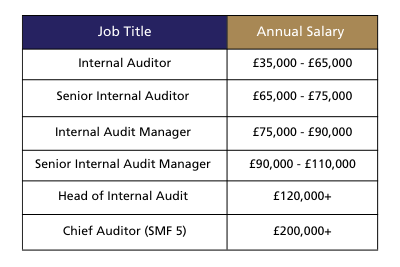

Salaries for Internal Auditors in the London financial services market

Why make the move to internal audit?

Above all, internal audit offers career stability. Businesses will always need internal auditors irrespective of market conditions.

I have been placing internal audit candidates for several years, and many of them report there is the opportunity to travel to exotic places. I don't know about you, but flying business class and staying in five-star hotels is certainly appealing after the past two years and numerous lockdowns we’ve experienced!

Finally, it’s an amazing opportunity to garner a holistic view of the wider business, beyond one particular function.

My predictions for the internal audit market for 2022

Personally, I think the second half of the year will follow the trend set out in the first quarter of this year. There will continue to be high demands and short supplies of qualified internal auditors across all levels. Demand will be especially high for newly qualified auditors and senior subject-matter experts.

To combat this shortage, businesses will need to start planting the seed early on and invest in their graduate intake, or be prepared to engage in bidding wars.

What would also aid businesses is that during the first stage interview process, hiring managers educate newly qualified candidates, who may not have experience in internal audit (external only), on the differences between internal vs external, and why a career in internal audit is an attractive option for them. As for these candidates’ perspectives, the world is their oyster, and they need your guidance! If businesses get into a habit of this, they will get more commitment and interest from candidates, as well as a smooth hiring process

How can Marks Sattin help you move into internal audit?

The first step to joining the exciting world of internal audit is to ensure you hold an accountancy qualification. Financial services businesses in London prefer you to hold ACA or ACCA. However, they are open to alternative qualifications, such as CIA, CISA (IT Audit). You will need some experience working in an audit function, but there is no set rule, it just needs to be evidenced in your work history.

As the UK and Ireland’s premier finance and accountancy recruitment specialist, we have unparalleled access to a range of internal audit roles to fit your personality and skills. Our consultants have in-depth knowledge of trends, packages, and can effectively consult on your career journey.

If you would like to discuss any of the above and understand what a finance recruitment agency can offer you, please reach out to me. Alternatively, if you are looking to start your UK finance and accountancy career, check out our latest finance and accounting vacancies.